Related Pages

Foreign Corrupt Practices Act (FCPA)

What potential whistleblowers need to know about reporting unlawful activity under the Foreign Corrupt Practices Act (FCPA)

What it Means to be a FCPA Whistleblower

The Foreign Corrupt Practices Act (FCPA) was enacted in 1977 in response to widespread bribery of foreign officials by U.S. companies.

The FCPA was intended to stop those practices, create a level playing field for honest business, and restore public confidence in the integrity of the marketplace.

Whistleblowers who report violations of the FCPA to the SEC Whistleblower Program may be eligible to receive a whistleblower reward. You do not need to be a citizen of the U.S. to be eligible for a whistleblower reward.

What is the Foreign Corrupt Practices Act?

The Foreign Corrupt Practices Act (FCPA) is a federal anti-bribery law passed in 1977 in response to widespread bribery in the form of payments by U.S. companies to foreign officials in exchange for business overseas.

In the years since the Act’s passage, the Securities and Exchange Commission and Department of Justice have regularly initiated enforcement actions against companies that violate its provisions. FCPA enforcement actions have recovered billions of dollars in civil and criminal penalties and have proven to be crucial tools in fighting corporate corruption.

How the FCPA Targets International Corruption

The FCPA, 15 U.S.C. §78dd-1, addresses the problem of international corruption in two key ways:

- First, the anti-bribery provisions prohibit individuals and businesses from bribing foreign government officials to obtain or retain business, and

- Second, the accounting provisions impose certain record keeping and internal control requirements and prohibit falsifying company books and records.

Violating the FCPA can lead to civil and criminal penalties, sanctions, and remedies including fines, disgorgement, and/or imprisonment.

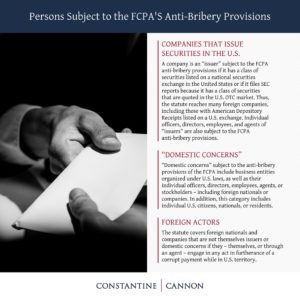

Individuals and Entities Subject to the FCPA Anti-Bribery Provisions

The FCPA covers three categories of individuals and entities.

Companies that Issue Securities in the U.S.

A company is an “issuer” subject to the FCPA anti-bribery provisions if it has a class of securities listed on a national securities exchange in the United States or if it files SEC reports because it has a class of securities that are quoted in the U.S. OTC market. Thus, the statute reaches many foreign companies, including those with American Depository Receipts listed on a U.S. exchange. Individual officers, directors, employees, and agents of “issuers” are also subject to the FCPA anti-bribery provisions.

“Domestic Concerns”

“Domestic concerns” subject to the anti-bribery provisions of the FCPA include business entities organized under U.S. laws, as well as their individual officers, directors, employees, agents, or stockholders – including foreign nationals or companies. In addition, this category includes individual U.S. citizens, nationals, or residents.

Foreign Actors

Finally, the statute covers foreign nationals and companies that are not themselves issuers or domestic concerns if they – themselves, or through an agent – engage in any act in furtherance of a corrupt payment while in U.S. territory.

The FCPA Targets Bribery

The FCPA broadly applies to any payment intended to induce or influence a foreign official to use his or her position to assist a company in obtaining, retaining, or securing any kind of business advantage. For example, the FCPA covers bribes to:

- Avoid contract termination;

- Secure favorable tax treatment;

- Evade taxes or penalties;

- Reduce or eliminate customs duties;

- Obtain government action to prevent competitors from entering a market;

- Circumvent a licensing or permit requirement;

- Obtain exceptions to regulations; or

- Influence the adjudication of lawsuits or enforcement actions.

The FCPA covers actual bribes as well as offers and promises to bribe. Bribery takes the form of money—often disguised as “consulting fees” or “commissions” given through intermediaries—as well as virtually any form of consideration or thing of value, including gifts, meals, travel, and entertainment.

The FCPA Requires Specific Accounting Procedures

Issuers, as well as their subsidiaries and affiliates, are subject to the accounting provisions of the FCPA. These provisions require that covered companies:

- First, must keep “books and records” that accurately and fairly report the entity’s transactions.

- Second, must maintain a system of “internal controls” sufficient to assure management’s control, authority, and responsibility over the company’s assets.

An issuer can violate FCPA accounting provisions even if it never engages in bribery. The markets rely on an issuer’s financial statements to accurately and completely reflect the company’s business and transactions between the company and its customers and business partners.

FCPA Violations

Both the Department of Justice and the SEC are responsible for enforcing the FCPA. Only DOJ has the authority to pursue criminal actions under the FCPA; both the DOJ and SEC have the authority to pursue civil enforcement actions under the FCPA.

A person or entity found in violation of the Act is subject to both civil and criminal penalties. The U.S. Government takes corruption very seriously, and the penalties for violating the FCPA include large fines and jail time.

The FCPA provides specific penalty amounts for criminal violations of the anti-bribery and accounting provisions of the FCPA, and the Alternative Fines Act further provides that a defendant may be liable for a penalty up to two times as large as the benefit that it sought to obtain.

In addition, the DOJ or SEC may impose civil penalties, which can be substantial, and the defendant may face collateral consequences including debarment and injunctive relief.

How FCPA Whistleblowers Can Prevent Corruption and Foreign Bribery

Whistleblowers with knowledge of FCPA violations may be able to make a claim to the SEC Whistleblower Program, which provides awards for whistleblowers. Whistleblowers do not need to live in, or be citizens of the United States. Indeed, it is common for international whistleblowers to have important evidence of FCPA violations. Wherever they come from, whistleblowers have been recognized by the U.S. as among the most “powerful weapons” in rooting out fraud:

Assistance and information from whistleblower can be among the most powerful weapons in the law enforcement arsenal. Through their knowledge of the circumstances and individuals involved, whistleblowers can help SEC and DOJ identify potential violations much earlier than might otherwise have been possible, thus allowing SEC and DOJ to minimize the harm to investors, better preserve the integrity of the U.S. capital markets, and more swiftly hold accountable those responsible for unlawful conduct.

FCPA Whistleblower Awards

Since it began in 2012, the SEC’s whistleblower program has awarded hundreds of millions to whistleblowers. Whistleblowers are entitled to anywhere between 10% and 30% of the relevant settlement recovered as a result of any enforcement actions against the bad actor. For example, if the SEC recovered $50 million in civil penalties, an eligible whistleblower would be entitled to between $5 million and $15 million.

Whether you receive an award on the higher or lower end of that range depends on a number of factors, including the quality and significance of the information provided, the government’s interest in the particular violations, and your assistance during the investigation.

If you are thinking of becoming an FCPA whistleblower, you should speak with an attorney experienced in representing FCPA whistleblowers. An experienced FCPA whistleblower attorney can help you evaluate your potential submission and prepare a strong submission to the SEC. Anonymity and confidentiality are also common concerns of FCPA whistleblowers; an experienced FCPA whistleblower attorney can help you navigate your options, protect your identity, and advise you on your rights against retaliation. And, should the SEC recover from the defendant, an experienced FCPA whistleblower attorney can help you maximize your reward.

Contact a Foreign Bribery and FCPA Whistleblower Lawyer

Whether to become a whistleblower is an important decision. If you have information about possible FCPA violations, and would like to talk to the whistleblower attorneys at Constantine Cannon, please contact us today for a confidential consultation.