Record-Setting Submissions: CFTC Whistleblower Program 2020 Annual Report Documents Increasing Popularity of Program

Every year, the Commodity Futures Trading Commission is required to report to Congress about the CFTC Whistleblower Reward Program, created by the Dodd-Frank Act, which pays awards to eligible whistleblowers who voluntarily provide the Commission with original information, about matters within the CFTC’s jurisdiction, that leads to the recovery of more than $1 million in monetary sanctions. This week, the CFTC released its 2020 Annual Report covering the fiscal year ending September 30, 2020, with detail on the number of whistleblower awards granted and the total amount of CFTC whistleblower awards paid, along with other information of interest to potential whistleblowers and their attorneys.

According to the CFTC Whistleblower 2020 Annual Report, during the past year, the Commission:

- Issued 11 final orders granting 16 applications for whistleblower rewards

- Paid “approximately $20 million” to successful whistleblowers

- Issued 61 final orders denying 80 additional applications for whistleblower rewards on the grounds that the applicants did not meet the program’s requirements

- Received a record-high 1,030 new whistleblower submissions using the CFTC “tip, complaint, or referral,” or “TCR” forms and procedures

- Received a record-high 140 whistleblower award applications using the CFTC WB-APP forms and procedures.

The CFTC’s statistics show the increasing popularity of its whistleblower reward program, with a substantial increase in the number of whistleblower tips submitted. Indeed, the CFTC has previously acknowledged the importance of whistleblowers in its enforcement actions, stating in 2019 that nearly 40% of the Enforcement Division’s ongoing investigations involved “some whistleblower component.”

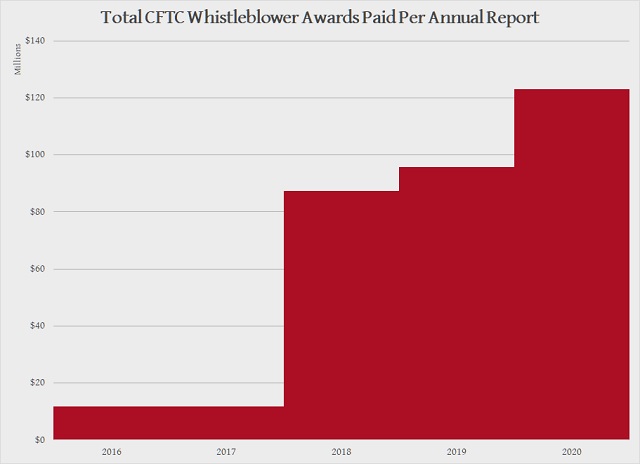

With this year’s whistleblower awards, the CFTC reports that it has granted more than $120 million in awards. While this is great news for whistleblowers, it is even better news for the integrity of the markets regulated by the CFTC: Commission actions associated with whistleblower awards have resulted in sanctions orders totaling nearly $1 billion.

Increasing Competition for CFTC Whistleblower Awards

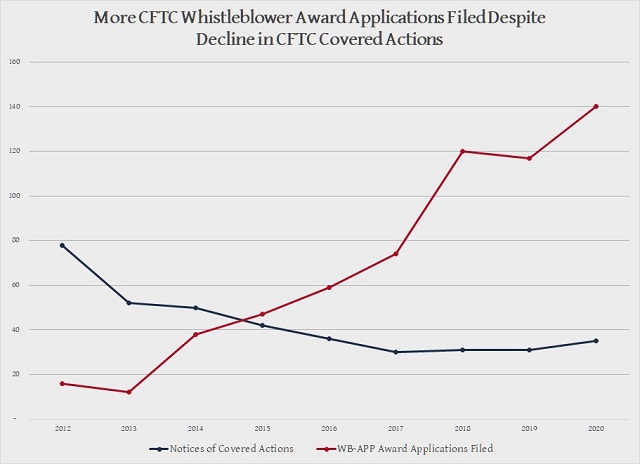

In addition to reporting on the number of whistleblower award applications (WB-APP) it receives each year, the CFTC also reports on the number of “covered actions” each year, referring to recoveries that are eligible for payout of whistleblower awards. To be timely, WB-APPs must be submitted within 90 days of the posting of the Notice of Covered Action.

As said above, this year saw a record-breaking number of WB-APP submissions. However, the number of Covered Actions has not increased. In fact, the number of Covered Actions has gone down since the program began, while the number of WB-APPs has steadily increased.

There are a number of possible reasons for this divergence.

- First, multiple whistleblowers can be eligible for an award based on a single covered action. The steady increase in TCR submissions over the years makes it more likely that there will be multiple whistleblower claimants for every Covered Action.

- Second, WB-APP submissions may involve government recoveries in “related actions,” which are not posted by the CFTC as “Covered Actions” – but which are still subject to the 90-day filing rule.

- Third, growing awareness of the CFTC whistleblower program has no doubt increased the number of applications from individuals who do not meet the requirements for an award. (In 2017, the CFTC enacted rules that streamlined disposition of facially ineligible applications, a process the CFTC report notes was used 59 times in the past year)

Whatever the reasons, with both the number of TCRs increasing, and the number of WB-APPs increasing, it appears that there will be increasing competition for CFTC attention and whistleblower rewards.

After Lean Years, Awards Increase

While the CFTC Whistleblower Reward Program has paid more than $120 million in awards, it is notable that over half of that amount was paid in a single year, 2018. This year represents the second-highest total award payouts and, with 16 separate awards issued in 11 orders, 2020 accounts for approximately half of the total number of CFTC whistleblower awards issued.

There are several notable awards included in the annual report – although, consistent with the anonymity guarantees of the program, the CFTC report and other public statements do not identify the whistleblowers or even the underlying enforcement action:

- A $9 million award – one of the five largest in the history of the program – to a whistleblower whose specific, credible, and timely tip led the Commission to open an investigation and ultimately bring a successful enforcement action

- A $6 million award to a whistleblower who voluntarily provided original information which was specific, credible, and timely and that led the CFTC to bring a successful enforcement action.

- A total of $2 million to four whistleblowers who jointly submitted a tip that led to a successful CFTC enforcement action as well as related actions by a different regulator.

- An award of $1 million to a whistleblower who first provided the information through their employer’s internal compliance program to another regulator, and subsequently provided the information directly to the CFTC. While the whistleblower did not identify the exact wrongdoing ultimately charged by the CFTC, their evidence led the CFTC to critical evidence.

- A joint award to two whistleblowers who reported an ongoing fraud. The first whistleblower, based in the U.S., made the first report and provided information and documents that would have otherwise been difficult to obtain. The second whistleblower, based abroad, provided additional information, including the wrongdoers’ attempts to avoid detection.

Lessons for Potential CFTC Whistleblowers

The CFTC Whistleblower Program provides incentives to individuals to report violations occurring in markets regulated by the CFTC. Monetary rewards, prohibitions on job retaliation, and confidentiality protect and compensate whistleblowers who report improper conduct. Whistleblowers play a vital role in CFTC enforcement efforts, exposing bad actors and violations of the laws and regulations that protect market participants and our financial system.

The CFTC 2020 Annual Report states that whistleblower submissions covered a wide range of wrongful activities, including failures to supervise; record keeping or registration violations; swap dealer business conduct; wash trading; solicitation, misappropriation, and other types of fraud; use of deceptive or manipulative devices in trading; as well as spoofing and other forms of disruptive trading or market manipulation.

With so many more TCRs being submitted, and so many WB-APPs being submitted, it is important for a whistleblower to ensure that they have met all program requirements and presented their information and arguments in the most effective way possible. Frauds that violate the Commodity Exchange Act and applicable regulations are often complicated, and an experienced attorney can help evaluate evidence and effectively present information to government decision-makers.

Many of the CFTC whistleblower award decisions note that the whistleblower provided effective assistance during the CFTC’s investigation. Experienced whistleblower attorneys know how to provide effective assistance to the government, and understand the benefits that come from providing such assistance throughout any investigation.

Many CFTC whistleblower awards involve investigations by multiple agencies, and claims by multiple whistleblowers. To ensure that a whistleblower’s rights are protected with respect to recoveries in related actions, and as against claims by other whistleblowers, the advice of an experienced professional is critical.

The whistleblower attorneys of Constantine Cannon have extensive experience representing Dodd-Frank whistleblowers before the CFTC and SEC, and understand the complicated, constantly changing landscape of whistleblower laws. If you would like more information or would like to speak to a member of Constantine Cannon’s whistleblower lawyer team, please Contact us for a Confidential Consultation.

Read More:

- The CFTC Whistleblower Program

- What Whistleblower Should Know about the Dodd-Frank Act

- Fraud in Markets Regulated by the CFTC

- CFTC Enforcement Actions

- 2019 Annual Report: CFTC Whistleblower Program Annual Report Shows Program Open for Business, yet Challenges Persist

- Think you have a whistleblower case?

- Contact us for a Confidential Consultation

Tagged in: CFTC Whistleblower Reward Program, Financial and Investment Fraud, Fraud in CFTC-Regulated Markets, Statistics,