DOJ Seeks to Close the Book on Penguin Random House’s Acquisition of Simon & Schuster

On November 2, the U.S. Department of Justice (“DOJ”) once again demonstrated its renewed resolve to block anticompetitive concentrations by filing a civil antitrust lawsuit seeking to block Penguin Random House LLC’s proposed acquisition of its close competitor, Simon & Shuster.

DOJ alleges that the merger would give Penguin Random House “outsized influence over who and what is published, and how much authors are paid for their work,” resulting in “fewer authors being able to make a living from writing and fewer and less diverse books being published.”

This merger challenge is notable for its focus on the transaction’s buyer-side implications on authors, including what the major publishing houses pay for their work. This reflects the increasingly mainstream view that antitrust law has focused too much on seller-side market power, while ignoring how our increasingly concentrated economy has resulted in buyer-side power that has harmed competition in input markets such as labor markets. The primary question raised by this merger is whether it would give the merged entity monopsony power in the “general trade books” publishing industry, which would result in authors being paid less for their work.

Like most merger challenges, this case likely will come down to whose concept of the market is adopted. The complaint defines “general trade books” as books “published for wide public consumption, including both fiction and a variety of non-fiction such as biographies, cookbooks, travel guides, and self-help books.” This definition excludes academic texts and professional manuals. The pleading explains that publishers negotiate with authors to obtain “a license for the book’s publishing rights,” which generally include “the right to publish a book in various formats (print, e-book, audiobook)” within a particular geographic area.

According to DOJ, the book publishing market in the United States is dominated by the “Big Five” publishers: Penguin Random House, Simon & Schuster, HarperCollins Publisher, Hachette Book Group, and Macmillan Publishing Group, LLC. The complaint quotes Penguin Random House’s parent company, Bertelsmann SE & Co. KGaA (“Bertelsmann”), as characterizing the U.S. publishing industry as an “oligopoly.”

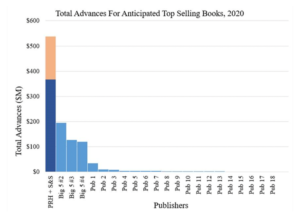

As proof of the power of the merging parties, DOJ notes that in 2020 Penguin Random House and Simon & Schuster paid authors a combined total of more than $500 million for the rights to publish books those publishers anticipated would be top-sellers. By comparison, the next biggest publisher paid less than $200 million in advances for the rights to anticipated top-selling books.

(Source: DOJ complaint.)

DOJ delineates two relevant buyer-side markets: “the acquisition of U.S. publishing rights to books from authors” and “the acquisition of U.S. publishing rights to anticipated top-selling books.” The first alleged relevant market includes the acquisition of U.S. publishing rights to books written by all authors. The second relevant market—the “anticipated top-selling books” market—is included in the first product market. The authors selling rights in this narrower market “generally command higher advances than other authors.”

For both markets, small publishers do not provide meaningful competition to the Big Five, according to DOJ. Small publishers lack the resources available to the Big Five. They also do not enjoy the scale economies that the large publishers have. , such as strong editorial and publishing capabilities, larger marketing and promotional budgets, as well as “name recognition and a demonstrated track record to convince authors of anticipated top-selling books to consider switching publishers.” The complaint illustrates how Simon & Schuster’s late CEO derisively described non-Big Five publishers as “farm teams for authors.” By contrast, she described other Big Five publishers as “our biggest competitors, especially for books by already bestselling authors and celebrities.”

Additionally, DOJ alleges that neither self-publishing nor “work-for-hire” arrangements can be a reasonable alternative to the Big Five. Self-published authors do not have “the breadth of editorial, distribution, and marketing services” that are offered by the Big Five. According to the complaint, Simon & Schuster’s internal documents acknowledge that “[s]elf-publishing is not viewed as a threat to [our] core business.” The “work-for-hire” authors typically relinquish their publishing rights to the publishers, and are compensated differently from authors who sell their publishing rights in exchange for an advance and royalties.

Although Penguin Random House has attempted to justify the merger on the basis that it will “provide a counterweight” to Amazon’s alleged buying power, its own documents undermine this claim. According to the complaint, Penguin Random House executives, in seeking approval from Bertelmann’s Supervisory Board for the acquisition, stated that the acquisition would advance their “[g]oal” to be an “[e]xceptional partner for Amazon.” Yet, “when asked whether he viewed the proposed merger as counterweight to Amazon,” Penguin Random House’s Global CEO replied: “No, I’ve never, never bought into that argument ….”

The complaint provides vivid details of competition between Penguin Random House and Simon & Schuster, which the proposed merger threatens to eliminate. For example, in 2019, the two publishers fought for the publishing rights of “a memoir by a Grammy-Award winning singer.” The bidding began at $5 million, and after the bidding war between the two companies, Simon & Schuster won the rights at $8 million. Also in 2019, the two publishers fought for a book based on a Broadway play. Each publisher bid $1.4 million, resulting in a “beauty contest” based on the services each publisher could offer the author.

Along with the risk of eliminating head-to-head competition, DOJ alleges that the proposed merger will likely reduce competition by “facilitating coordination between the remaining major publishers.” Because only a few large players dominate the industry, “the terms of author contracts, other than advances, have become fairly standardized over time.” Communications between employees of rival publishers is common, and information about competitors’ actions is widely available. As such, the industry’s market structure is already conducive to coordinated behavior, and the merger threatens to make that structure even worse for competition.

To defend the merger as procompetitive, Penguin Random House and Simon & Schuster claimed that the merger would create positive “synergies.” What those synergies might be is unclear. Another “defense” proffered by Penguin Random House sounds doubtful. Penguin Random House owns more than 90 imprints (a trade or brand name for a specific group of editors, e.g., Doubleday) and Simon & Schuster owns over 30 imprints. Penguin Random House announced that, post-merger, its imprints and legacy Simon & Schuster imprints would “continue bidding against one another.” In other words, after securing “nearly half the market for publishing rights,” the merged entity will continue to compete against itself. Such an arrangement makes no economic sense.

The complaint quotes Penguin Random House’s U.S. CEO as stating that “[B]ooks have the power to sustain us, particularly in challenging times ….” But Penguin Random House’s Global CEO put it more succinctly: “Books matter ….”

Indeed, books do matter in terms of broadening our views and enriching our internal lives. It remains to be seen whether the proposed merger will bring its purported “synergies” to the market, or whether DOJ’s challenge to protect competition leaves the door open for improvements in the publishing industry. If competition in the industry is given a chance to expand, rather than to contract, there will likely be greater opportunities for authors and more diverse selections of books for readers.

Written by Yo Shiina

Edited by Gary J. Malone

Tagged in: Antitrust Enforcement, Antitrust Litigation,