Proposed Changes to NY FCA Tax Provisions Rattle Potential Tax Fraudsters

Answers to Common Questions from Prospective IRS Whistleblowers

[caption id="attachment_46025" align="alignright" width="325"] Click for full size image[/caption]

Although some state False Claims Acts allow whistleblowers to bring lawsuits based on violations of state and local tax laws, the federal False Claims Act (FCA) specifically excludes tax claims.

Fortunately, the Tax Relief and Health Care Act of...

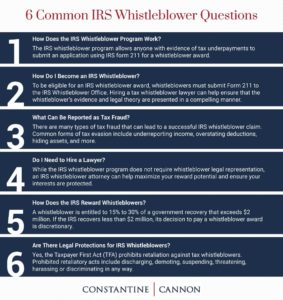

Click for full size image[/caption]

Although some state False Claims Acts allow whistleblowers to bring lawsuits based on violations of state and local tax laws, the federal False Claims Act (FCA) specifically excludes tax claims.

Fortunately, the Tax Relief and Health Care Act of...