How to Become an IRS Whistleblower

Answers to Common Questions from Prospective IRS Whistleblowers

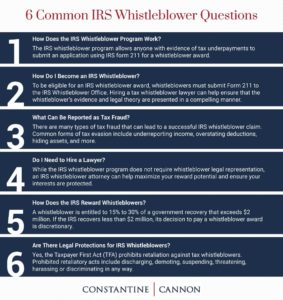

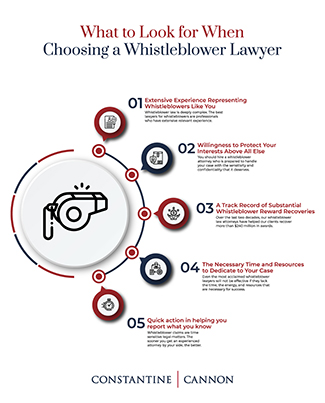

[caption id="attachment_46025" align="alignright" width="325"] Click for full size image[/caption]

Although some state False Claims Acts allow whistleblowers to bring lawsuits based on violations of state and local tax laws, the federal False Claims Act (FCA) specifically excludes tax claims.

Fortunately, the Tax Relief and Health Care Act of...

Click for full size image[/caption]

Although some state False Claims Acts allow whistleblowers to bring lawsuits based on violations of state and local tax laws, the federal False Claims Act (FCA) specifically excludes tax claims.

Fortunately, the Tax Relief and Health Care Act of...

Frequently Asked Question: Am I entitled to a whistleblower award if I report fraud or misconduct to the government?

Answer: You might be, depending on the nature of the fraud or misconduct you are reporting, the government agency you report it to, and the manner and timing of your reporting.

More Information: Under the whistleblower provisions of the federal

Frequently Asked Question: Am I entitled to a whistleblower award if I report fraud or misconduct to the government?

Answer: You might be, depending on the nature of the fraud or misconduct you are reporting, the government agency you report it to, and the manner and timing of your reporting.

More Information: Under the whistleblower provisions of the federal