DOJ FY2022 Annual Fraud Report Shows $2.2 Billion in Total Recoveries, with $1.9 Billion Thanks to Whistleblowers - But There are Reasons for Concern

The Department of Justice released its annual report of civil recoveries for fraud and false claims against the U.S., showing $2.2 billion in settlements and judgments for the fiscal year ending September 2022. The data released by DOJ show the critical role that whistleblowers play in securing these recoveries for the government: of the $2.2 billion recovered, $1.96 billion – 89% – was recovered in cases initiated by whistleblowers under the False Claims Act. This 89% whistleblower rate is significantly above the 76% average in the same time period.

Even more notably, over half of the total was recovered by whistleblowers in cases where the government declined to intervene, and the whistleblowers pursued recoveries on their own. Let’s say that again: over half of the total recoveries were in cases that the government chose not to litigate.

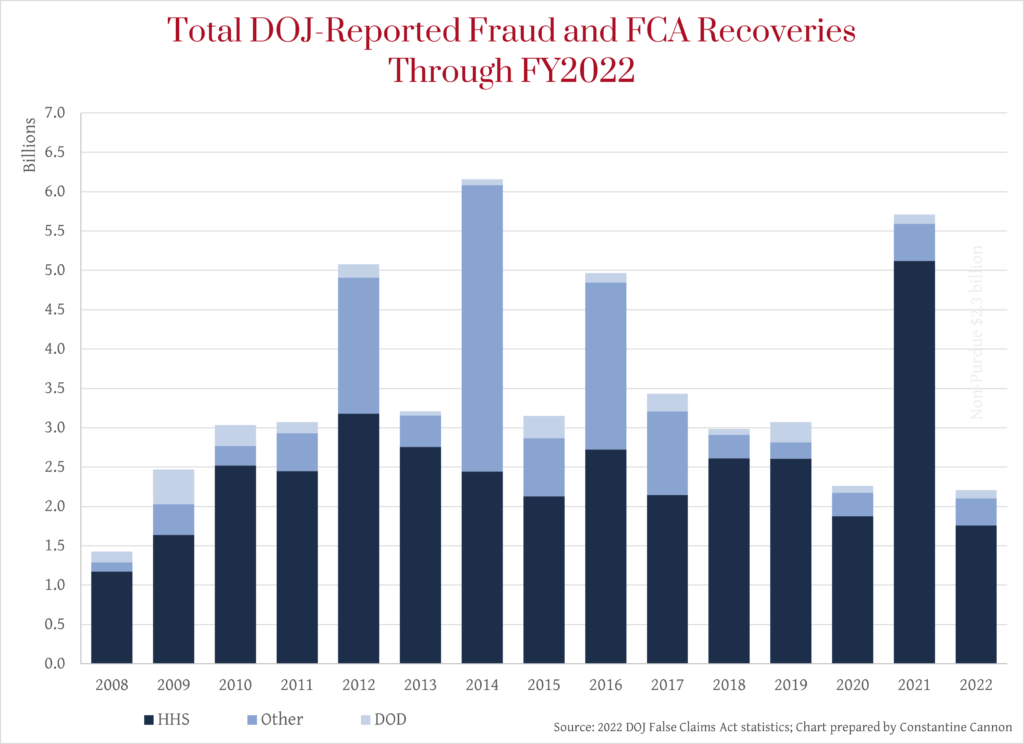

In announcing the results, DOJ touted that they were achieved in 351 different resolutions, “the second highest number of settlements and judgments in a single year.” This seems like an impressive number – nearly one a day! – and surely represents a huge amount of work by dedicated DOJ attorneys. However, $2.2 billion in recoveries represents the lowest reported DOJ recoveries since 2008 – and over half of those recoveries were in non-intervened cases.

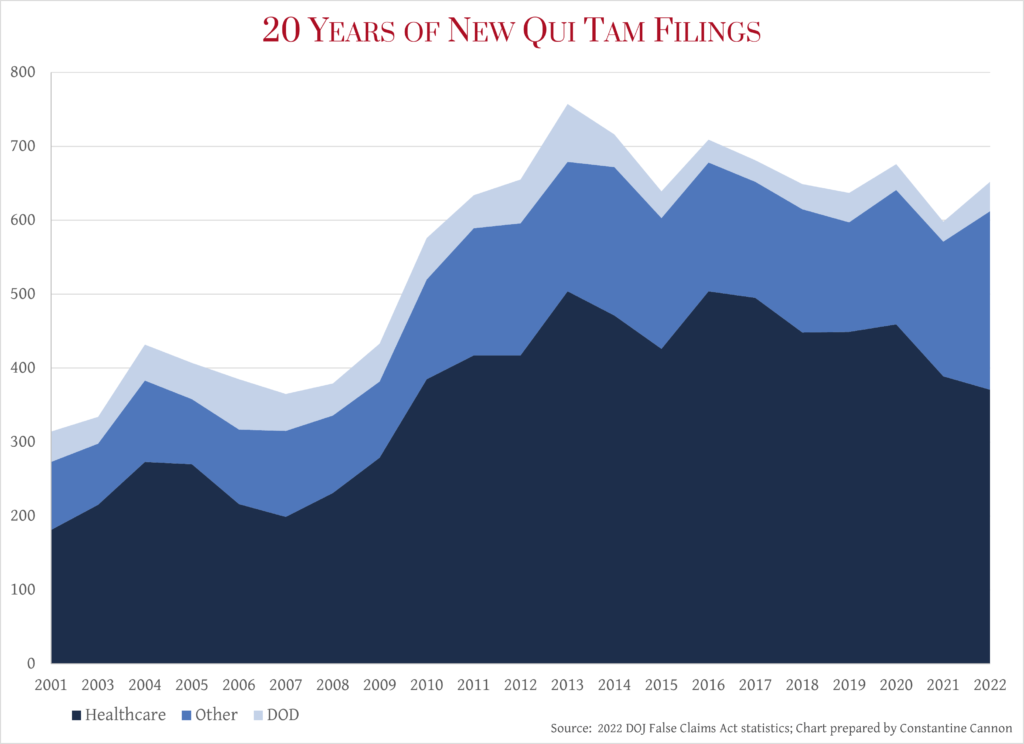

Nevertheless, despite the lower recoveries, it is important that cases are reaching resolution – particularly as new qui tam filings recovered some from a dip last year, with a particular increase in new filings outside of the healthcare and DOD fields. While we cannot know the nature of those recent filings, the increase in new filings outside of healthcare and DOD aligns with new enforcement priorities identified by DOJ, including fraud in pandemic relief programs and alleged violations of cybersecurity requirements in government contracts and grants.

Healthcare Fraud Dominates Recoveries

Following the usual pattern, healthcare is the leading source of recoveries under the False Claims Act, with the government and whistleblowers recoveries restoring funds to government healthcare programs including Medicare, Medicaid, and TRICARE. Government healthcare spending has grown tremendously over the decades, and it should be no surprise that healthcare fraud is an enforcement priority, or that healthcare recoveries represent the lion’s share of DOJ fraud recoveries.

Our review of the top healthcare fraud recoveries of calendar year 2022 features many of the matters that contributed to this year’s success, including the $900 million Biogen settlement, in a case pursued by a whistleblower without the government’s intervention, which also topped our 2022 Whistleblower Awards list. The government’s press release also features the second entry on our Healthcare Top Ten, pharma company Mallinckrodt’s agreement to pay $260 million to resolve allegations that the company failed to pay amounts it owed under the Medicaid Drug Rebate Program.

Whistleblowers Needed More Than Ever

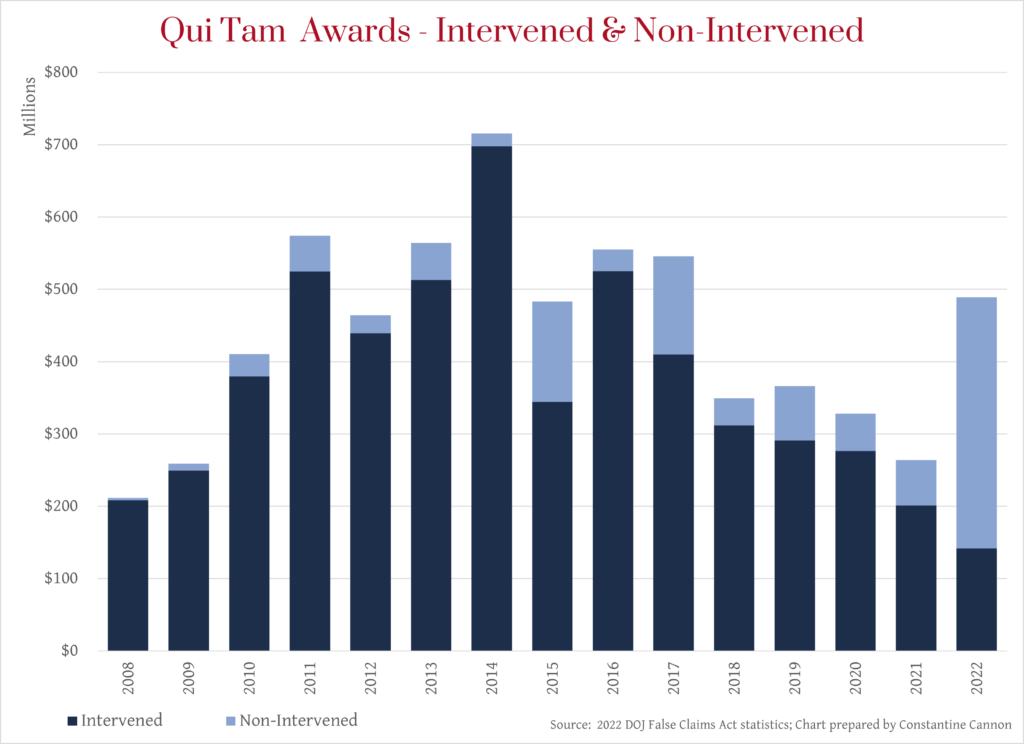

During FY2022, the federal government paid out nearly $489 million to whistleblowers who filed actions under the qui tam provisions of the False Claims Act, reversing a downward trend seen in prior years. However, over half of this total consists of a record-shattering $266.4 million to the whistleblower in the Biogen case. Aside from that blockbuster settlement, total whistleblower awards continued a troubling multi-year slide.

While FY2022 did see an increase in new qui tam filings over FY2021, several details stand out. First, new healthcare qui tam actions declined this year, continuing a pattern we have seen over several years. Indeed, new healthcare qui tam filings are declining even more than new filings overall. Second, the False Claims Act has not seen the significant increases in new filings that both the SEC Whistleblower Program and CFTC Whistleblower Program have seen over the past years. Third, while the increase in new filings outside of healthcare and DOD is encouraging, the total new filings has not kept pace with increases in government spending.

In sum: whistleblowers are critical to the government’s fraud recoveries. That’s clear from the numbers, and Acting Assistant Attorney General Brian M. Boynton is quoted in the DOJ press release, saying that DOJ’s “ability to protect citizens and taxpayer funds continues to benefit greatly” from whistleblowers, who “often put[] at risk their careers and reputations.” However, whistleblower awards are declining and, over the past decades, recoveries under the False Claims Act have declined relative to related government spending. At the same time, government budgets for enforcement are stretched and new whistleblower filings are declining.

Given the acknowledged significant role of whistleblowers in DOJ enforcement, any signs of a decline in whistleblower filings should be a cause for concern to the Department of Justice – as well as to taxpayers and legislators. Senator Charles Grassley (R-Iowa), a proponent of the False Claims Act, has warned that “despite the False Claims Act’s overwhelming success, courts and defendants” repeatedly have sought to “mischaracterize and weaken the law,” including by pushing policies that “could undermine the purpose of the False Claims Act by discouraging whistleblowers.”

More than taxpayer dollars are at stake. As DOJ notes, healthcare fraud can cause real damage to patients through medically unnecessary procedures and potentially harmful actions. Senator Grassley has made the same point with respect to defense contracts and other government spending, arguing to the Senate that “fraud can put lives at risk, including those of our military, law enforcement and veterans.”

DOJ’s recoveries are impressive in many ways. Since 1986, the False Claims Act has returned more than $72.5 billion to taxpayers. But, we should be alert to signs of brewing trouble behind the big numbers. Strengthening enforcement of the False Claim Act is the best way to recognize the importance of whistleblowers – and the best way to recover taxpayer dollars. Active enforcement and meaningful whistleblower protections and rewards are essential to encourage whistleblowers to come forward and report fraud that may otherwise go undetected.

Becoming a whistleblower is rarely an easy decision, but holding wrongdoers to account is the right thing to do. For potential whistleblowers, it is important to find a lawyer who will be candid about the risks and rewards of being a whistleblower, who has extensive experience representing whistleblowers, and a record of success.

Our Whistleblower Insider blog regularly analyzes the reports of federal agencies that work with whistleblowers. If you would like more information about these annual reports or have questions about bringing a whistleblower claim, please contact us for a confidential conversation.

Read More:

- The False Claims Act

- Healthcare Fraud

- Government Contract Fraud

- COVID-19 Fraud

- Top-10 Lists of Fraud and Whistleblower Cases

- I think I have a whistleblower case

- The Constantine Cannon Whistleblower Team

- Contact Us for a Confidential Consultation

Tagged in: COVID-19, FCA Federal, Government Procurement Fraud, Healthcare Fraud, Importance of Whistleblowers, Statistics,