IRS Makes its 2020 Whistleblower Report to Congress: Mandatory Awards Hold Steady, but Long Delays Continue

2020 proved to be a difficult year for most people, but within the tumult of the year the IRS Whistleblower Office continued to work and on December 29, 2020 provided its annual report to Congress (for fiscal year ending September 30, 2020). The report showed a mixed bag of success and difficulties in addressing tax fraud and awarding whistleblowers.

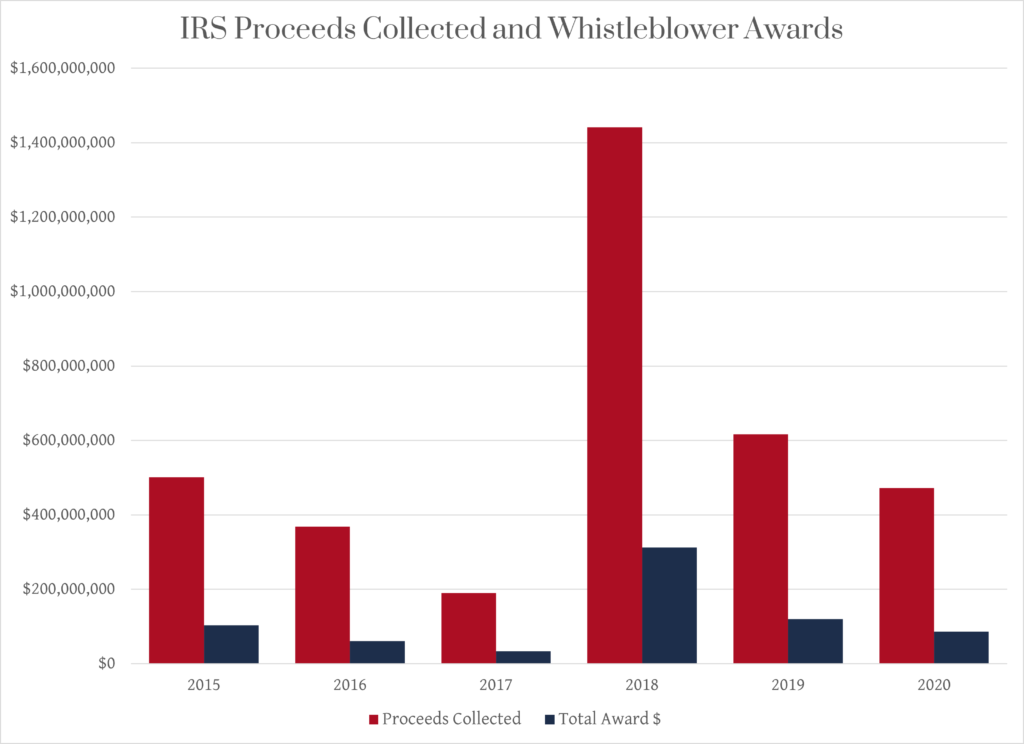

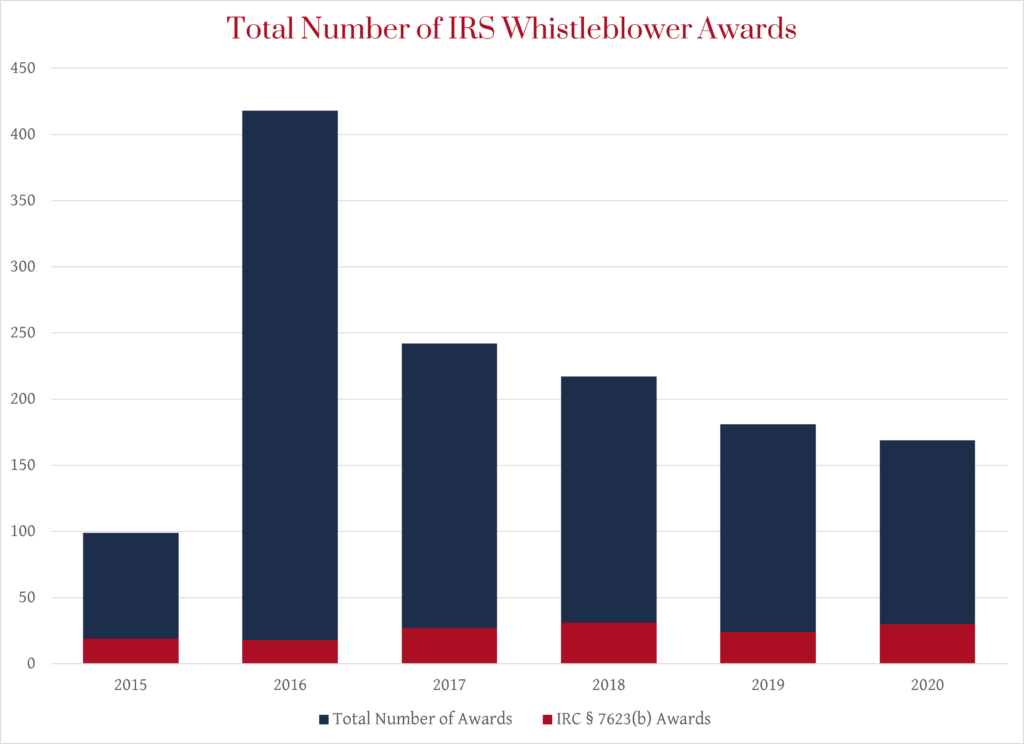

The IRS Whistleblower Office made 169 awards to whistleblowers in fiscal year 2020, totaling almost $87 million, and collected more than $472 million in proceeds. This amount includes 30 awards under Internal Revenue Code §7623(b) – mandatory awards in large cases.

These numbers reflect a decrease in the value of whistleblower awards made, as well as a decrease in proceeds collected – although 2020 does exceed some prior years.

As for the number of awards made, it is notable that while the total number of awards made has declined, there has been a steady number of mandatory awards under § 7623(b) over the past three years.

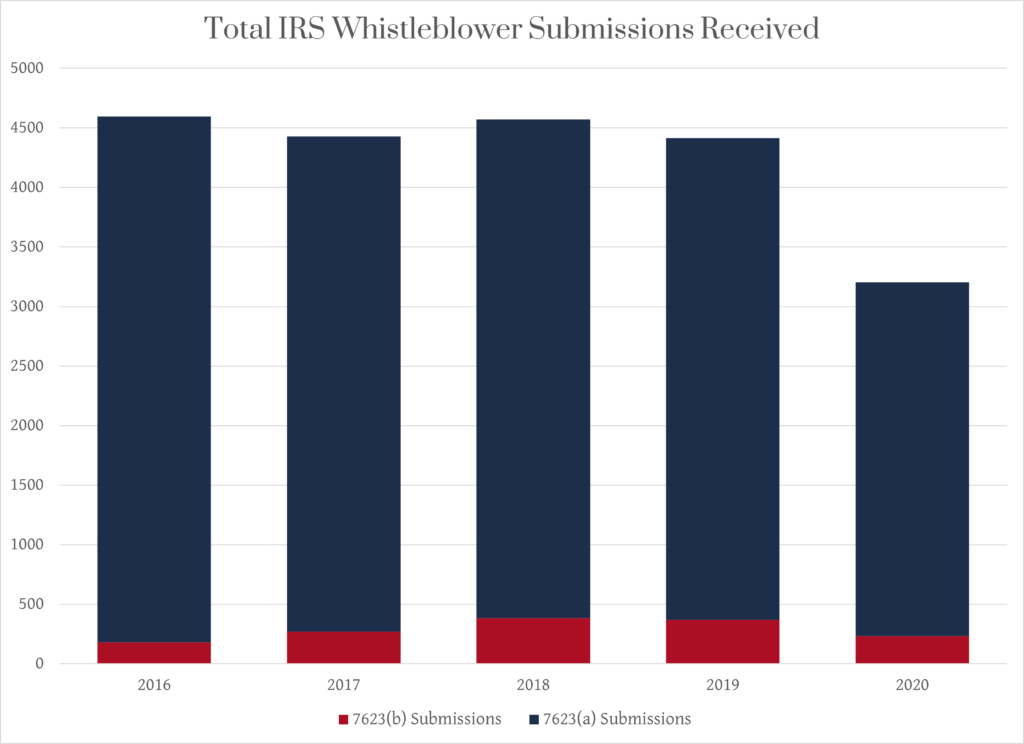

The IRS provides two types of whistleblower awards: mandatory awards under § 7623(b), where the whistleblower’s information has substantially contribute to the government’s recovery of at least $2 million, and discretionary awards under § 7623(a), which may be made in cases that do not meet the dollar $2 million threshold or cases involving individual taxpayers with gross income of less that $200,000. Claims classified under § 7623(b) typically involve large tax avoidance schemes, corporate tax fraud, and fraud by high net worth individuals.

Year to year, the vast majority of whistleblower claims received by the IRS are classified as non-mandatory. In fiscal year 2020, the IRS reported that only 233 out of 3,204 total claims were mandatory claims under § 7623(b). And, while 2020 did see an overall decline in submissions, the decline was less notable with respect to mandatory claims.

So, while FY2020 saw a decline in the total amount of awards, the total proceeds collected, and the percentage of awards of proceeds collected – certainly, not an honor roll of success – the situation is slightly less dire with respect to mandatory claims under § 7623(b).

Some of the decline can of course be attributed to delays caused by the Coronavirus, and the report notes that a number of office operations had to be temporarily suspended. In addition, the office has long suffered from a lack of resources.

This lack of resources is particularly apparent in the continued high delays in processing award claims by the whistleblower office. In fact, over the last three years the processing delays have become worse.

- In FY 2018: § 7623(a) claims took on average 8.08 years to process and § 7623(b) claims took on average 9.32 years to process.

- In FY 2019: § 7623(a) claims took on average 6.56 years to process and § 7623(b) claims took on average 10.31 years to process.

- In FY 2020: § 7623(a) claims took on average 8.36 years to process and § 7623(b) claims took on average 10.79 years to process.

These long delays in processing IRS whistleblower claims have long concerned whistleblowers and the office alike and will remain a priority item for the office to address in FY 2021 and beyond. The whistleblower office has cut down the number of open claims in 2020, but as of the release of the report, 23,943 claims still remain open, many of which have been in process for many years.

Several other notable points of information from the IRS whistleblower office’s annual report:

- The majority of submissions and claim numbers received in FY 2020 were assigned to the Small Business/Self-Employed division meaning the taxpayers at issue had assets of less than $10 million.

- Approximately 62% of § 7623(b) claims assigned to the Criminal Investigation division were sent to the field auditors to be examined.

- The whistleblower office closed 11,135 claims in FY 2020 of which 46% were for allegations that were not specific, credible, or were speculative in nature. These types of claims were also closed on average in only 143 days.

If you believe you might have some useful information regarding potential tax fraud violations and would like to speak to an experienced member of the Constantine Cannon whistleblower lawyer team, please do not hesitate to contact us.

READ MORE

- Tax Fraud

- IRS Whistleblower Program

- Our other posts on Tax Enforcement Actions

- Whistleblower FAQs

Tagged in: IRS Whistleblower Reward Program, Statistics, Tax Fraud,