IRS Whistleblower Office Issues Delayed and Disappointing Annual Report on Whistleblower Program in Fiscal Year 2021

The IRS Whistleblower Office has released its required Annual Report to Congress, covering fiscal year 2021. Disappointingly, the report shows a continuing decline in proceeds collected as a result of submissions to the IRS Whistleblower Program and a continuing decline in awards paid to whistleblowers who reported tax fraud under the program. The report itself was submitted four months later than in previous years – FY2021 ended over eight months ago – and delay is also a feature of its substance, as the IRS reports a continuing increase in the timeline for processing of whistleblower submissions.

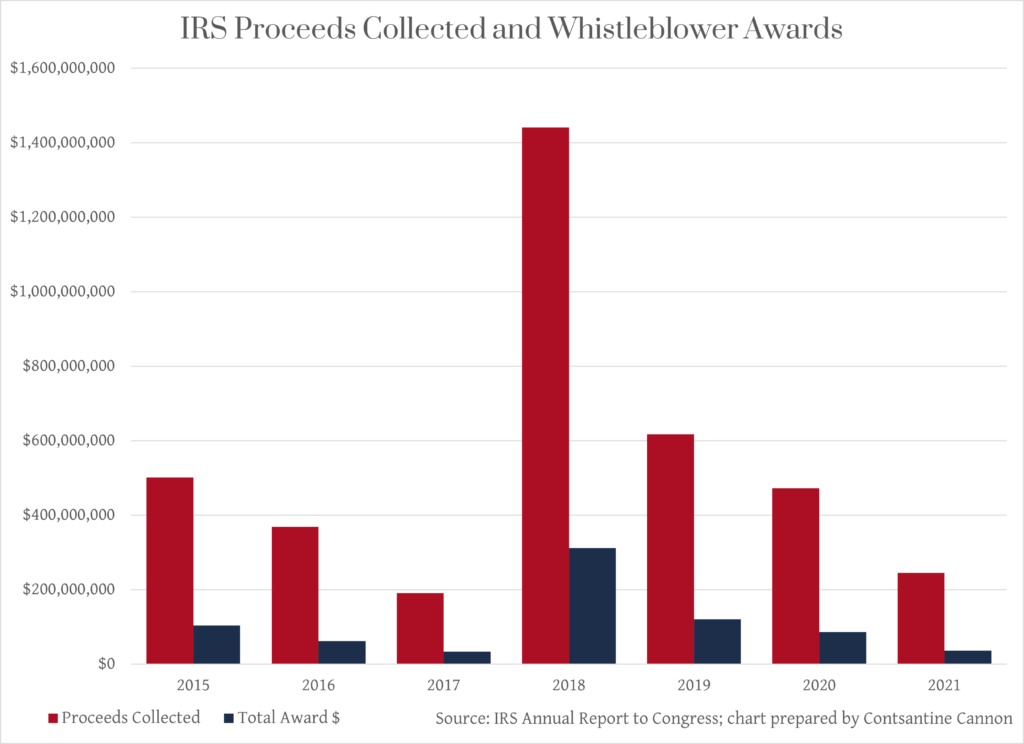

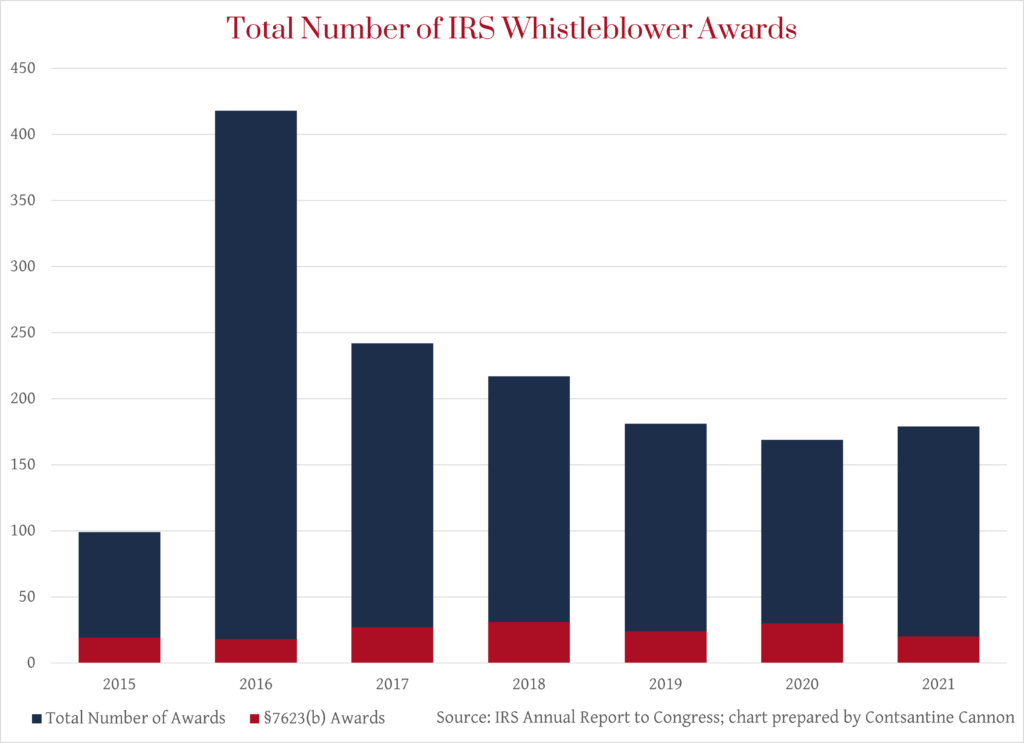

The IRS Whistleblower Office made 179 awards to whistleblowers in fiscal year 2021, totaling over $36 million, and collected more than $245 million in proceeds.

It is important to note, however, that most of those 179 IRS whistleblower rewards were made under §7623(a), meaning that they were discretionary awards in cases recovering less than $2 million, or cases involving individual taxpayers with gross income of less that $200,000. Awards under §7623(b) are larger on average, as claims classified under §7623(b) typically involve large tax avoidance schemes, corporate tax fraud, and fraud by high net worth individuals. In FY2021, the IRS made 20 awards under Internal Revenue Code §7623(b), and the IRS report shows that the average §7623(b) award was over $1.3 million. By contrast, the average §7623(a) award was approximately $55,000.

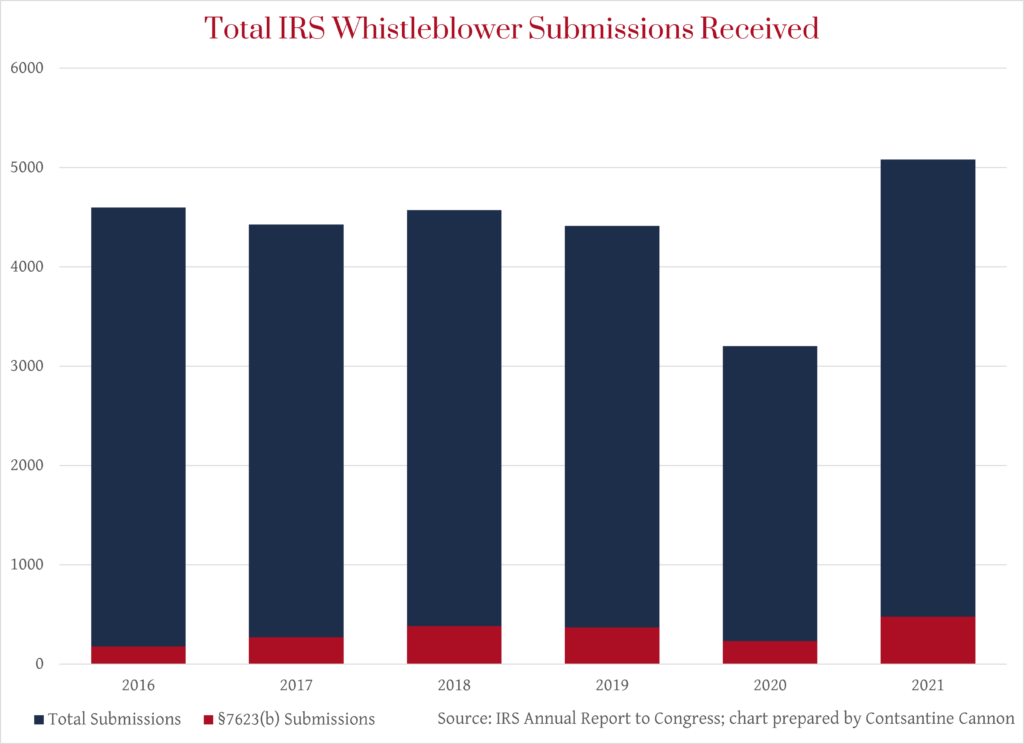

As the above graph shows, the prevalence of §7623(a) awards has been consistent over the years. The same holds true with respect to new tips received: §7623(a) predominates.

Indeed, this year the IRS began reporting the types of fraud alleged, and among the most common frauds reported are those likely to fall under §7623(a): false dependent exemptions, wages paid in cash/under the table, unreported income, employee/subcontractor classifications, and the like. Consistent with this, the majority of submissions and claim numbers received in FY 2021 were assigned to the Small Business/Self-Employed division meaning the taxpayers at issue had assets of less than $10 million.

IRS Whistleblower Office Backlog Grows as Timelines Lengthen

The report also includes detail on growing claim backlogs and lengthening claim processing timelines. The Whistleblower Office reports that it currently has 27,017 open claims, nearly 2,000 of which are claims under §7623(b), and closed 12,584 claims in FY2021.

The IRS Whistleblower Office measures the timeline for claim processing and award payment, by comparing the date the whistleblower initially submits a Form 211 (start date) with the date the award is paid (end date). These measures also show a worsening of conditions: §7623(a) claims took an average of 8.5 years to process, and §7623(b) claims took an average of 11.1 years to process. Both of these represent an increase from prior years, and the report notes a “high likelihood that the average claim processing times will continue to increase as claim inventory continues to age while the Whistleblower Office awaits audits, exams, investigations, appeals, tech services, collection, statutes to expire, and whistleblower litigation.”

IRS Whistleblowers Can Help Fill the Tax Gap

Since 2007, the IRS has recovered nearly $6.4 billion as the result of information provided by whistleblowers under the IRS Whistleblower Reward Program – a substantial recovery for the public fisc by any measure. And, the IRS Whistleblower Program has paid over 2,500 whistleblower awards totaling more than $1.05 billion. By any measure again, the IRS Whistleblower Program has demonstrated that it can provide real bang for its buck, with whistleblowers uniquely positioned to provide information about tax fraud and evasion that the IRS would not otherwise have access to.

The IRS Whistleblower Program has achieved these results despite chronic under-funding and cumbersome limitations on cooperation and transparency between law enforcement and whistleblowers. However, the FY2021 report shows that the agency continues to respond to whistleblower submissions, particularly for whistleblowers submitting claims under §7623(b) that are assigned for criminal investigation or to the department’s Large Business and International Division. Nearly 100% of §7623(b) submissions assigned to the Criminal Investigation Division were referred for field examination; over 20% of such claims assigned to LB&I were assigned for field examination.

However, some changes that could improve the program are within reach. We have previously proposed that the IRS Whistleblower Office undertake efforts to be more transparent in communicating with whistleblowers, leverage the expertise and knowledge of whistleblowers, and accelerate the tip and reward process. The FY2021 report highlights some improvements in this area, but there is more work to be done. With administrative reorganizations undertaken in FY2021 and the selection of a new director, John Hinman, who started in May of 2022, improvements in these areas may be on the way.

The IRS Whistleblower Office also highlights that it is considering procedures to avoid the consumption of resources on non-meritorious claims. As the data above suggests, the volume of 7623(a) submissions and award claims may have an outsized impact on IRS Whistleblower Office resources. The Whistleblower Office also acknowledges that it faces administrative burdens from those who submit multiple claims relating to the same information, or numerous claims based entirely on publicly available information. According to the report, “some whistleblowers have submitted hundreds of such claims.” While the office processes and responds to all claims, the report states that it plans to study options to address duplicative or non-meritorious claims in a summary fashion.

Read More:

- IRS Whistleblower FAQs

- Tax Fraud

- The IRS Whistleblower Program

- How Congress and the IRS Can Fulfill the Promise of the Tax Whistleblower Program

- Contact us for a confidential consultation

Tagged in: IRS Whistleblower Reward Program, Statistics, Tax Fraud,