SEC Whistleblower Program 2019 Annual Report Tells Story of Significant Impact - Despite Beginning the Year with a Government Shutdown

In its 2019 Annual Report to Congress, the SEC Office of the Whistleblower described its program as continuing to have a “significant impact” on enforcement and investor protection efforts. In the fiscal year that ended in September 2019, the SEC Whistleblower Program received the second highest number of tips in program history, and issued the third largest whistleblower award to date.

These numbers illustrate the benefits of the SEC Whistleblower Program, which reached a “momentous milestone” this year: wrongdoers have paid over $2 billion in monetary sanctions in enforcement matters brought with information from whistleblowers. In addition, the SEC reports that harmed investors have received, or are scheduled to receive, almost $500 million of payments collected as disgorgement.

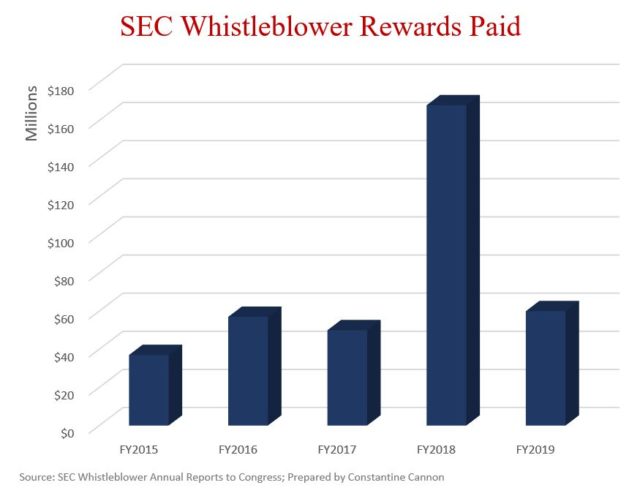

Rewards Maintain Pre-2018 Levels Despite Month-long Shutdown

The SEC Whistleblower Program awarded over $60 million in whistleblower rewards in FY 2019, despite the historic 35-day government shutdown from December 22, 2018 to January 25, 2019. The total is a significant decline from FY2018, but that may say more about FY2018 than it does about FY2019. Indeed, the total aggregate whistleblower awards issued in the past year second only to FY2018.

The FY 2019 awards were paid to eight individuals, and include the third largest whistleblower award to date. A few notable awards:

- $50 Million to two individuals in the same covered action, reported to arise from a $267 million settlement with JP Morgan concerning disclosure issues to customers. One whistleblower, Ted Siedle, received a $37 million award, the third largest single amount paid to a whistleblower by the SEC; and the other received a $13 million award.

- $4.5 million to one individual, in the first ever award under a rule incentivizing internal reporting.

- $3 million to joint anonymous whistleblowers in June 2019.

Incoming Tips Continue at High Levels

The SEC received over 5,200 whistleblower tips in FY2019. Again, this is second only to FY 2018, and marks the second consecutive year the SEC received over 5,000 tips. The continuing high levels of tips may be attributed to continuing impact from the February 2018 Supreme Court decision in Digital Realty v. Somers, which held that the Dodd-Frank law’s anti-retaliation provisions protected employees only if they had reported a possible violation to the SEC.

The tips received came from around the country and around the world. Within the United States, California (546), Pennsylvania (332), New York (290), Texas (245), and Florida (241) had the highest numbers of whistleblower tips submitted.

Many international whistleblowers also submitted claims, with submissions coming from 70 different countries. According to the SEC, 9% of the individuals making whistleblower claims submitted claims from abroad. Canada (71), the United Kingdom (44), and Australia (28) collectively account for 143 of these individuals. Also of note are 44 whistleblowers from Germany, 32 from the People’s Republic of China, 27 from India, 22 from Russia, 20 from South Africa, and 15 from Brazil.

Lessons for Would-Be Whistleblowers

With over 5,200 claims made in the year, the SEC Office of the Whistleblower has to triage incoming claims. The Annual Report provides importance insights on the types of submissions that are more likely to be prioritized by the SEC.

- Specific Information. The SEC notes that successful whistleblowers named individuals involved in the misconduct, provided documents supporting their allegations (or explained where such documents could be located), and often identified specific financial transactions.

- Wrongful conduct. According to the SEC, successful whistleblowers often report relatively current or ongoing misconduct. The SEC is particularly interested in widespread or multi-year securities violations, and in misconduct that impacts retail customers.

- Ongoing assistance. The report states that nearly all award recipients provided the SEC with assistance beyond the initial submission, by answering staff questions, providing testimony, or otherwise.

Notably, while the majority (approximately 68%) of award recipients made submissions that caused an investigation or enforcement action to be opened, nearly one-third of whistleblower award recipients received awards because their information assisted with an already-existing investigation or examination. Where a whistleblower is not the initiator of the action or investigation, the SEC considers factors such as whether the additional information provided by the whistleblower allowed the SEC to accelerate or streamline an action and whether it supported additional charges.

An attorney experienced in representing SEC whistleblowers can provide invaluable assistance in submitting a strong claim to the SEC. The Whistleblower Lawyer Team at Constantine Cannon helps whistleblowers evaluate their potential claims and determine whether the misconduct can form the basis of a whistleblower claim. With a history of successful partnerships with government agencies including the SEC, we know how to collect and present information to the relevant decision-makers, and how to provide effective assistance to the government throughout the investigation and any subsequent proceedings, including a claim for a whistleblower reward. If you would like more information or would like to speak to a member of Constantine Cannon’s whistleblower lawyer team, please contact us for a Confidential Consultation.

READ MORE

- The SEC Whistleblower Program

- SEC Enforcement Actions

- Financial & Investment Fraud

- The SEC Whistleblower Program 2018 Annual Report: Record-Breaking Year for the SEC Whistleblower Program

- The CFTC Whistleblower Program 2019 Annual Report: CFTC Whistleblower Program Annual Report Shows Program Open for Business, yet Challenges Persist

- I Think I Have a Whistleblower Case

Tagged in: Financial and Investment Fraud, Importance of Whistleblowers, SEC Whistleblower Reward Program, Securities Fraud, Statistics,