False Claims Act

What potential whistleblowers need to know about bringing a qui tam lawsuit under the federal False Claims Act.

Whistleblowers and the False Claims Act

The federal False Claims Act is the foundation of the U.S. whistleblower reward system. Whistleblowers can bring claims under the FCA to report fraud and misconduct in federal government contracts and programs.

The FCA allows private persons, known as relators, to bring what are called qui tam lawsuits on the government’s behalf, with the promise of a potential reward of a portion of the government’s recovery (between 15% and 30%).

False Claims Act Topics Covered Here:

History of the False Claims Act

The False Claims Act, 31 U.S.C. § 3729 et seq., was enacted in 1863 to fight widespread fraud by companies selling rotten food, sickly mules, and defective weapons to the Union Army during the Civil War. The law is rooted in thirteenth-century England’s tradition of the qui tam, derived from a Latin phrase meaning “he who sues on our Lord the King’s behalf as well as his own.”

The whistleblower provisions of the False Claims Act were largely ignored until increased military spending in the 1980s. Then, widespread reports of shocking abuses by government contractors circulated: $400 bills for hammers, $1,000 for bolts, and $7,000 for coffee pots. Iowa’s Senator Charles Grassley (R) helped to amend the FCA in 1986 to give it more teeth and to make it more attractive to whistleblowers. These changes ushered in the modern era of FCA enforcement. For defendants, fines of up to $10,000 for each false claim and tripling of damages were introduced. The fines for each false claim increase regularly. For whistleblowers, rewards of up to 30% of the government’s recovery were added, along with significant protections from retaliation. In 2009 and 2010, the law was revised to provide greater protections and incentives for whistleblowers.

The Elements of a Claim Under the False Claims Act

The cornerstone of a whistleblower case under the False Claims Act is evidence that fraud or misconduct caused the federal government to suffer a loss. The false claim can take many forms:

- Overcharging the government for a product or service.

- Providing the government with a product or service that is substandard or otherwise different from what the government agreed to pay for.

- Underpaying the government or avoiding an obligation to pay the government (for obligations other than taxes).

- Keeping an overpayment received from the government.

To be a violation of the FCA, a defendant’s wrongful actions must be “knowing.” Deliberate ignorance or reckless disregard of the truth of the claim is sufficient to show knowing conduct.

Under the False Claims Act, the government may recover three times its actual losses, referred to as “treble damages.” In addition, a defendant may be liable for penalties for each false claim submitted.

Wherever federal government money is involved, there may be a claim under the False Claims Act. Fraud that violates the False Claims Act can happen in numerous industries and involve a wide range of government programs:

- Healthcare and Pharmaceutical

- Government Contract Fraud

- Fraud in Other Government Programs

- Financial and Investment Fraud

- International

- Housing and Mortgage Fraud

- Environmental

- Insurance

The False Claims Act Process

A case under the False Claims Act is filed in federal district court “under seal.” The complaint and evidence in support of the whistleblower’s claims are provided only to the United States Department of Justice, including the local United States Attorney, and to the assigned judge of the district court. While the complaint is under seal – a time period that is often extended multiple times – DOJ will investigate the allegations. DOJ, sometimes along with other law enforcement agencies, will ordinarily interview the relator, and may subpoena documents, interview other witnesses, and consult with agency personnel and other experts.

The government must decide whether or not it will seek to intervene in the action. When the government intervenes in a case initiated by a whistleblower, the government takes over the litigation. If the government does not intervene, the relator has the option of continuing the case on behalf of the government.

Whistleblower Rewards Under the False Claims Act

If money is recovered for the government in a qui tam case, the whistleblower is ordinarily entitled to a share of that recovery. If the government intervened in the case, the FCA sets the relator’s share between 15 and 25% of the amount recovered. If the government did not intervene, the relator’s share is higher: between 25 and 30% of the amount recovered. The actual whistleblower share depends on many factors, including the quality of information provided by the whistleblower, and the assistance provided by the whistleblower and whistleblower’s counsel.

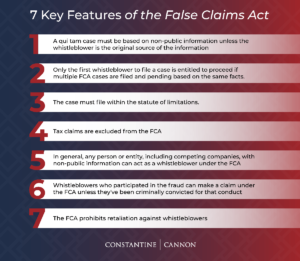

Key Features of the False Claims Act

- A qui tam case must be based on non-public information, unless the whistleblower is the original source of the information that has been made public, or the government objects to dismissal of the whistleblower’s case.

- If multiple FCA cases based on the same facts are filed and pending, only the first whistleblower to file a case is entitled to proceed. The first-to-file rule makes it important that a whistleblower with knowledge of fraud speak with experienced qui tam counsel as soon as possible.

- The case must be filed within the statute of limitations. A case under the FCA generally needs to be filed within six years of the false claim, or three years after the government knows or should have known about the false claim. The FCA also sets an outer limit, saying that in no case may a case be brought more than 10 years after the false claim.

- Tax claims are excluded from the FCA. However, the IRS Whistleblower Program may be available to whistleblowers with knowledge of tax fraud.

- In general, any person or entity, including competing companies, with non-public information can act as a whistleblower under the FCA. Whistleblowers do not need to be company insiders, and they do not need to be U.S. citizens. FCA whistleblower rewards have been paid to employees of defendants, former employees, customers, competitors, and industry experts, among others.

- Whistleblowers who participated in the fraud can make a claim under the FCA, unless they have been criminally convicted for that conduct. However, if the whistleblower planned and initiated the fraudulent scheme, the relator’s share amount may be reduced below the statutory amounts.

- The FCA prohibits retaliation against whistleblowers, and allows whistleblowers who have been retaliated against to seek double damages and other remedies.

Speak to a Qui Tam Whistleblower Attorney About Your Case

This description of the elements and procedures of the False Claims Act is general in nature. The FCA and the law surrounding it is complex. The whistleblower attorneys of Constantine Cannon understand the complicated, constantly changing landscape of state and federal whistleblower laws. If you would like more information or would like to speak to a member of Constantine Cannon’s whistleblower lawyer team, please Contact us for a Confidential Consultation.

Learn more about being a whistleblower: