Common Ownership in the Draft Merger Guidelines: A Sea Change for Index Funds?

By Wyatt Fore

[Draft] Guideline 12: Acquisitions of partial control or common ownership may in some situations substantially lessen competition.[1]

Portfolio investors may soon find that their investments could be the subject of increased antitrust scrutiny, resulting from new federal enforcement guidelines.

On July 19, 2023, the U.S. Department of Justice and the Federal Trade Commission issued new Draft Merger Guidelines. Although the Draft Guidelines have made news for many reasons, one underappreciated feature is the explicit inclusion—for the first time—of issues relating to common ownership.

Common Ownership

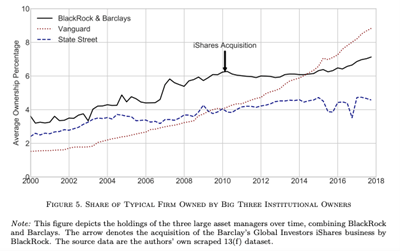

Common ownership, or horizontal shareholding, refers to situations in which a single investor has ownership stakes in two or more horizontal competitors. Today, common ownership levels are high, especially as index and exchange traded funds offered by portfolio investors (like BlackRock, Vanguard and State Street) have risen in popularity. Ordinarily, these institutional investors have small—but significant—positions (often 4-10%) in major companies throughout a particular sector.

Figure 1[2]

Those institutional investors seek to maximize their overall returns across the entire portfolio, instead of focusing on their returns from stakes in particular firms. The competition concern is that this pursuit of portfolio returns can disincentivize “business stealing” between the companies in which they have invested.[3] For example, a company might ordinarily lower price or seek innovations to take market share from its competitor. But if an investor has stakes in both the company and its rival, it might not want the company to target its rival’s market share. This in turn dampens product market competition between those companies.

Moreover, even if an investor has a minority, noncontrolling stake in a firm, it can still influence the firm’s competitive decisions. American corporate law generally presumes that shareholders, even those with noncontrolling stakes can influence firm actions, proportional to other ownership interests. This occurs through all the “ordinary mechanisms” of corporate management, such as “shareholding voting, executive compensation, the market for corporate control, the stock market, and the labor market.”[4] For example, a minority investor might be less likely to discipline firm managers who fail to gain market share from the company’s rivals when the investor also has stakes in those rivals.

There has been significant theoretical research into the anticompetitive effects of common ownership, although the empirical evidence showing diminished product market competition has been somewhat mixed. Nonetheless, some economists have argued that common ownership in concentrated markets has had substantial anticompetitive effects, resulting in higher prices, diminished innovation and lower product quality in major sectors of the US economy.[5] As one prominent commentator, Prof. Einer Elhauge, has stated: “Dozens of empirical studies have now confirmed this economic reality that common shareholding alters corporate behavior. At least fifteen of those empirical studies have confirmed that horizontal ownership has anticompetitive effects in concentrated markets.”[6]

Partial Ownership and Section 7

Nothing in section 7 of the Clayton Act limits antitrust scrutiny to transactions of controlling interests. Rather, the focus is not on the form of a transaction, but whether the “effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.”[7] As a result, Supreme Court precedent has also long understood the antitrust laws to forbid partial acquisitions that may have a substantial anticompetitive effect.[8]

Antitrust law likewise recognizes that an investor’s ownership interests in rivals can raise competition concerns. In fact, some of antitrust law’s most foundational precedents, including Northern Securities[9] and Standard Oil,[10] address the very issue. And the antitrust agencies have increasingly focused on analogous issues, like interlocking directorates[11] and serial acquisitions[12], where rivals influence each other’s competitive decisions. Just last week, the Federal Trade Commission brought suit against a private equity firm that allegedly monopolized various anesthesiology markets through a “roll-up” strategy of purchasing rival practice groups to form a dominant entity.[13]

However, to our knowledge, there has been no case putting these two together, i.e., challenging common ownership issues arising out of minority, noncontrolling stakes. Given the increasing economic evidence that these scenarios raise serious competition concerns, and the proliferation of index funds in the economy, the issue is ripe for future consideration—and possible enforcement.

Draft Guideline 12: Tea Leaves for Possible Enforcement?

Without direct legal precedent addressing common ownership based on minority positions, the antitrust agencies draw from Supreme Court precedents relating to partial acquisitions. Draft Guideline 12 thus represents an ambitious attempt to apply existing legal precedents to new fact patterns and emerging areas of concern.

For example, Draft Guideline 12 notes:

“In some situations . . . the acquisition of less-than-full control may still influence decision-making at the target firm or another firm in ways that may substantially lessen competition. Acquisitions of partial ownership . . . may give the investor rights in the target firm, such as rights to appoint board members, observe board meetings, veto the firm’s ability to raise capital, or impact operational decisions, or access to competitively sensitive information.”[14]

These partial acquisitions thus may “change incentives so as to otherwise dampen competition.”[15]

Draft Guideline 12 then articulates three principles the Agencies will use to evaluate partial acquisition questions, including in common ownership situations.

- First, the antitrust agencies will consider the extent to which the acquisition allows the investor to influence, even if not fully control, the target firm’s conduct. This could include through a “voting interest” or other governance rights, such as “the right to appoint [board] members, influence capital budgets, determine investment return thresholds, or select particular managers[.]”[16] However, the antitrust agencies are careful to note that even a nonvoting interest can, in some cases, allow the investor to influence competitive decision-making.[17]

- Second, the antitrust agencies will consider whether the transaction lessens competition by “reducing the incentive of the acquiring firm to compete,”[18] even when the investor does not directly influence the firm’s conduct. This can occur, for example, if the firm receives a profit, dividend, or revenue share even when it loses business to a rival.

- Third, the antitrust agencies will consider the extent to which nonpublic, competitively sensitive information will be shared from the target firm.[19] Here, one concern is that the investor may facilitate information-sharing among rivals. But even absent information-sharing among rivals, the investor can still use the nonpublic information to dampen competition. For example, if “rivals know their efforts to win trading partners can be immediately appropriated” by the investor, those rivals “may see less value in taking competitive actions in the first place, resulting in a lessening of competition.”[20]

Of course, Draft Guideline 12 is, well, a draft. Only time will tell if the antitrust agencies decide to the adopt Draft Guideline 12, in part or in full.

Future Tools for Enforcement?

While the Draft Guidelines may be instructive, the antitrust agencies notably do not offer any bright lines about “how much”—and under what circumstances—horizontal shareholding may be illegal. Unlike presumptions in other contexts,[21] the antitrust agencies appear to be setting up the issue to percolate a bit to see where future research and precedent leads. For example, Draft Guideline 12 did not adopt a proposal by prominent commentators that would limit the ownership stakes that portfolio investors could take in direct competitors.[22]

Another notable omission from Draft Guideline 12 is any empirical or economic tool that will be needed to measure concentration effects from proposed transactions. Although other Draft Guidelines reference the familiar Herfindahl-Hirschman Index (“HHI”), economists have long criticized the use of HHI in partial acquisition or common ownership situations. In response, some economists have proposed alternative concentration tools, such as a Modified HHI (“MHHI”).[23] However, MHHI is not without its detractors.[24] As a result, it remains to be seen whether MHHI (or other economic tools) will emerge in common ownership enforcement.

Draft Guideline 12 thus leaves several questions open. These include: will the agencies use any concentration metrics, such as MHHI, in making enforcement decisions? And will the antitrust agencies develop any bright-line rules, similar to merger presumptions, to evaluate these transactions?

* * * *

Scholarship on common ownership has made waves in the antitrust world, especially empirical research suggesting significant anticompetitive effects flowing from those arrangements. With Draft Guideline 12, the antitrust agencies have identified partial acquisition and common ownership issues for consideration. Whether that will lead to future enforcement, and what tools the antitrust agencies use in making those decisions, will be closely watched for years to come.

Written by Wyatt Fore

Edited by Gary J. Malone

[1] U.S. Dep’t of Justice & Fed. Trade Commission, Draft Merger Guidelines 4 (2023) (“Draft Guidelines”).

[2] M. Backus, C. Conlon & M. Sinkinson, Common Ownership in America: 1980-2017, American Economic Journal: Microeconomics, 15, 273-308 (2021).

[3] See E. Elhauge, Horizontal Shareholding, 129 Harv. Law R. 1267, 1269 (2016).

[4] E. Elhauge, The Causal Mechanisms of Horizontal Shareholding, 82 Ohio St. Law J. 1, 7 (2021).

[5] J. Azar, S. Raina & M. Schmalz, Ultimate Ownership and Bank Competition (2019); J. Azar, M. Schmalz & I. Tecu, Anticompetitive Effects of Common Ownership, Journal of Finance, Vo. 73, No. 4 (2018).

[6] E. Elhauge, The Causal Mechanisms of Horizontal Shareholding, 82 Ohio St. Law J. 1, 3 (2021).

[7] 15 U.S.C. § 18 (emphasis added).

[8] E.g., Denver & Rio Grande v. United States, 387 U.S. 485 (1967); United States v. E.I. du Pont de Nemours & Co., 353 U.S. 586 (1957). See also United States v. Dairy Farmers of Am., Inc., 426 F.3d 850, 860-61 (6th Cir. 2005).

[9] Northern Securities Co. v. United States, 193 U.S. 197 (1908) (condemning under section 1 a series of transactions under which Northern Securities acquired a controlling interest in three railroads that had been competitors prior to acquisition).

[10] Standard Oil Co. of New Jersey v. United States, 221 U.S. 1 (1911) (Standard Oil illegally monopolized and restrained trade of oil refining industry, including through series of anticompetitive transactions eliminating competition among rivals).

[11] See Press Release, U.S. Dep’t of Justice, Two Pinterest Directors Resign from Nextdoor Board of Directors in Response to Justice Department’s Ongoing Enforcement Efforts Against Interlocking Directorates (Aug. 16, 2023).

[12] S. Palma & J. Fontanella-Khan, Crackdown on buyout deals coming, warns top US antitrust enforcer, Financial Times, May 18, 2022.

[13] Press Release, Fed. Trade Com’n. FTC Challenges Private Equity Firm’s Scheme to Suppress Competition in Anesthesiology Practices Across Texas (Sept. 21, 2023).

[14] Draft Guidelines at 27.

[15] Id.

[16] Id. at 27.

[17] Id.

[18] Id. at 28

[19] Id.

[20] Id.

[21] E.g., id. at 6-7, 17-18.

[22] E. Posner, F. Scott Morton & E.G. Weyl, A Proposal to Limit the Anti-Competitive Power of Institutional Investors, Antitrust L.J. (2017).

[23] E.g., D. P. O’Brien & S. C. Salop, Competitive Effects of Partial Ownership: Financial Interest and Corporate Control, 67 Antitrust L.J. 559 (2000); T. Bresnahan & S. C. Salop, Quantifying the Competitive Effects of Production Joint Ventures, 4. Int’l J. Indus. Org. 155, 156 (1986); J. Azar, M. Schmalz & I. Tecu, Anticompetitive Effects of Common Ownership, Journal of Finance, Vo. 73, No. 4 (2018); E. Posner, F. Scott Morton & E.G. Weyl, A Proposal to Limit the Anti-Competitive Power of Institutional Investors, Antitrust L.J. (2017).

[24] Douglas H. Ginsburg & Keith Klovers, Common Sense About Common Ownership, 2 Concurrences 1, 2 ¶ 6 (2018).