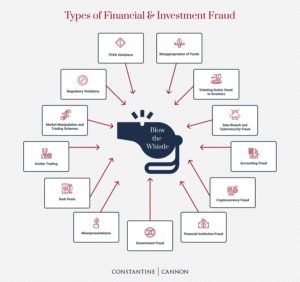

Financial & Investment Fraud

Learn More About Blowing the Whistle on Financial and Investment Fraud:

-

- Whistleblowers can Report and Prevent Financial and Investment Fraud

- What Types of Financial Fraud Can Whistleblowers Report?

- Misrepresentations, including accounting and financial reporting fraud

- Regulatory Violations

- Fraud in Go-Public Transactions, including IPOs and SPACs

- Violations of the Foreign Corrupt Practices Act

- Fraud and Misconduct by Investment Professionals

- Misappropriation of Funds, including Ponzi & pyramid schemes

- Market Manipulation and Trading Violations

- Dark Pools

- Insider Trading

- Data Breach and Cybersecurity Fraud

- Cryptocurrency Fraud

- Money Laundering, Sanctions Violations, and other Financial Institution Fraud

- Fraud Against Government Entities or Involving Government Programs

- Contact a Whistleblower Lawyer to Discuss Your Financial or Investment Fraud Case

Whistleblowers can report and prevent financial and investment fraud

Financial and investment fraud that harms investors and the financial markets is unfortunately common, and often hidden without information provided by whistleblowers.

Whistleblowers play a vital role in exposing financial fraud, bad actors, and violations of the laws and regulations that protect investors and our financial system.

Financial markets power our economy by providing businesses with capital to grow and finance their operations, and by providing income to investors. Millions of transactions between buyers and sellers occur every day, with incredible efficiency. This success depends on the integrity of the markets: on their proper operation, on the availability of accurate information, and on protections for investors.

Laws and regulations that protect investors, ensure the integrity of the markets, and regulate those who participate in the markets, are enforced by a number of agencies, including the U.S. Securities and Exchange Commission (“SEC”) and the Commodity Futures Trading Commission (“CFTC”).

The SEC Whistleblower Program and the CFTC Whistleblower Program both offer whistleblowers the ability to report fraud and receive a financial reward. Some states also provide awards for whistleblowers who disclose securities law violations to state authorities. Currently, such state securities whistleblower laws have been enacted in Indiana, Montana, Utah and Washington.

Financial fraud can also take the form of or result in tax fraud, which can be reported to the IRS Whistleblower Program.

Who Can Be Held Liable for Committing Financial Fraud?

Financial laws and regulations govern a large number of different actors, including:

- Issuers of securities

- Securities firms, broker-dealers, underwriters, and other market participants

- Exchanges

- Self-regulatory organizations

- Investment managers

- Credit rating agencies

- Accountants

- Financial institutions

What Types of Financial Fraud can Whistleblowers Report?

It would be impossible to list every type of financial fraud.

It would be impossible to list every type of financial fraud.

Actors in any part of the financial system may seek an unfair and unlawful advantage, skirt the rules, or set out to defraud others.

Below are just a few examples of the types of financial and investment fraud that a whistleblower may be able to report:

Misrepresentations

Misrepresentation and omissions are at the core of fraudulent conduct. A bad actor may lie about the value, costs, or nature of securities, futures, or other financial products or services. Misrepresentations also can take the form of the omission of material details and failure to make required disclosures.

Misrepresentations can also take the form of accounting fraud and the misstatement of financial results. Accounting and financial reporting fraud deprives investors, lenders, and others of accurate information.

Regulatory Violations

The securities laws enforced by the SEC and the Commodity Exchange Act enforced by the CFTC impose numerous obligations on parties subject to them, and violations of these regulations can serve as the basis of a whistleblower claims.

Among these are:

-

- Failing to make necessary and accurate statements in public filings

- Failing to register securities that are subject to registration

- Conducting improper off-exchange transactions

- Failing to register operations such as exchanges

- Individuals acting without required licenses.

Fraud in Go-Public Transactions, including IPOs and SPACs

Misrepresentations, backroom deals, and accounting manipulations in go-public transactions, including SPACs (Special Purpose Acquisition Companies) and IPOs (Initial Public Offerings) can give rise to liability.

Violations of the Foreign Corrupt Practices Act

The SEC and the Department of Justice jointly enforce the FCPA anti-bribery law, and whistleblowers can report violations of the FCPA to the SEC Whistleblower Program.

Fraud and Misconduct by Investment and Financial Professionals

Investment professionals, including brokers and investment advisors, owe duties to their clients, both retail investors and institutional investors. Investment professionals must make disclosures about their registration status, services offered, fees, conflicts of interest, and more. Investment and financial professionals must also collect specific information about their customers, and safeguard that information from disclosure.

The SEC and CFTC regularly bring enforcement actions against professionals who take actions that put their own interests before the interests of their clients, whether by recommending more expensive share classes that pay high fees to the investment professional, engaging in unauthorized trading, or knowingly recommending unsuitable investments.

Misappropriation of Funds

This can include ponzi schemes, pyramid schemes, and skimming.

Market Manipulation and Trading Violations

Trading of securities is highly regulated, and efforts to manipulate the market through trading violations and otherwise can give rise to liability.

Parties can face liability for engaging in pump and dump schemes, front running, spoofing, straw man purchases, naked short selling and illegal wash sales.

Dark Pools

A dark pool is is a private forum for trading securities, derivatives, and other financial instruments.

Dark pools allow trades, typically by institutional investors, without the volume or the price of the trade being revealed as it would be on a public exchange, reducing the chance that the orders could impact the market. While this lack of transparency serves as the reason to trade in dark pools, it can also make dark pools susceptible to conflicts of interest between their operators and their customers, and the targets of predatory trading practices by high frequency traders.

Regulations that may apply to dark pools and their operators include order protection rules and other obligations of broker-dealers to their customers. Whistleblowers can shine a light on dark pool operators and participants who fail to adhere to applicable regulations.

Insider Trading

Buying or selling a security on the basis of material information that is not known to the public can be unlawful insider trading.

Data Breach and Cybersecurity Fraud

The SEC requires public companies to promptly disclose all material cybersecurity risks and incidents and imposes additional requirements for registered broker-dealers, investment companies, and investment advisers who must safeguard confidential investor records and information.

Cryptocurrency Fraud

Cryptocurrency markets and regulation continue to evolve, and cryptocurrency remains an attractive target for fraudsters.

Money Laundering, Sanctions Violations, and other Fraud by Financial Institutions

Fraud by or involving financial institutions includes money laundering, sanctions violations, and false statements in a bank’s books and records.

Some types of financial institution fraud give rise to claims for violation of the Financial Institutions Reform, Recovery, and Enforcement Act, or FIRREA, which includes provisions for whistleblower rewards. While FIRREA was originally enacted to address fraud against banks, it has been applied to fraud by banks, where banks have themselves benefited from their wrongful conduct, for example by approving loans despite red flags of borrower misconduct, so that the bank could secure loan fees and/or re-sell the loan.

Fraud Against Government Entities or Involving Government Programs

Where government entities are market participants, for example acting as investors, as lenders, as purchasers of financial advice or financial products, or as issuers of securities such as municipal bonds or other public financing, they may be victims of financial fraud.

When the government entity that is a victim of a financial fraud is a state or local entity, a state or local False Claims Act may provide the ability for a whistleblower to report the fraud.

In addition, federal and state government entities act as funders, guarantors, or insurers under various programs. Where a party fraudulently obtains the benefits of such a program, for example by making misrepresentations on a loan application or causing others to do so, or misrepresenting the nature of a project for which a federal loan guarantee is sought, a whistleblower may be able to bring a claim under the federal False Claims Act or applicable state False Claims Act.

Examples of government programs that might be affected by such fraud include the funding programs of the CARES Act and other COVID-19 relief programs, including the Paycheck Protection Program and others, the Troubled Asset Relief Program (“TARP”), guarantees provided in the housing and mortgage industries, and federally-subsidized insurance programs.

Speak With a Whistleblower Attorney About Your Financial or Investment Fraud Case

We can’t list every way that financial and investor fraud occurs, and people are always finding new ways. Whistleblowers play a critical role in maintaining the integrity of the financial markets and protecting investors.

If you would like more information, or would like to speak to a member of the Constantine Cannon whistleblower lawyer team, please Contact us for a Confidential Consultation.