Accounting Fraud

Companies within the SEC’s purview are required to report their earnings and basic financial statement information to allow investors to make informed decisions about the company.

Unfortunately, some companies manipulate this data through fraudulent accounting practices.

Whistleblowers with knowledge of accounting fraud may be able to bring a claim under the SEC Whistleblower Reward Program.

Accounting Fraud Topics Covered Here:

Why Do Companies Engage in Accounting Fraud?

Companies may be tempted to commit accounting fraud for a variety of reasons:

- To hide losses,

- To overstate earnings, or

- To avoid investor or SEC inquiries.

In addition, executives within companies whose compensation is tied to certain financial statement results may find it tempting to manipulate those results and secure a bigger payday. A big enough misstatement can lead to a wildly swinging stock price, causing havoc that reverberates throughout the market.

Lenders also rely on accurate financial statements, and the disclosure of accounting misstatements can case a liquidity crisis for a company.

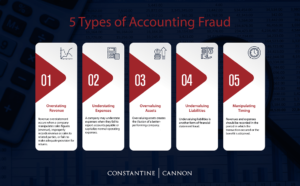

Types of Accounting Fraud

Accounting fraud takes many forms, including:

Overstating Revenue

A company may improperly record as revenues sales that are made to related parties, or fail to make adequate provision for returns. A company may overstate revenues by posting sales before they are made, before all conditions for the sale are met, or prior to payment.

Specific criteria must be met before revenue can be booked and it is premature to recognize revenue before all conditions are met. One form of revenue overstatement is “channel stuffing,” when a company inflates its revenue by sending retailers more products than they are able to sell to the public.

Understating Expenses

A company may fail to report accounts payable or may capitalize normal operating expenses.

In some cases of financial statement fraud, companies have improperly kept certain liabilities “off the books,” thereby understating expenses.

Overvaluing Assets

Overstatement of assets such as inventory and accounts receivable is a common form of accounting fraud.

In addition, the value of capital assets may be overstated, or a company may fail to record appropriate depreciation expenses.

Undervaluing Liabilities

Financial statement fraud can occur where a company understates its liabilities.

For example, a company may publicly set a reserve at one amount while knowing that, in fact, the value of the reserve should be higher.

Manipulating Timing

Revenues and expenses should be recorded in the period in which the transaction occurred or the period in which the benefit is obtained and, where possible, the expenses associated with a revenue item should be recorded in the same period.

While recognizing revenue early and expenses late may help in the short term, later periods will be hurt.

For those engaged in such fraud, the risks may seem worth it as the seek to “hit their numbers” or get to the next period that they are sure will make up for any problems.

Fraud in Government Contracting

Accounting fraud can also have an impact on some government contracts.

Accounting fraud can also have an impact on some government contracts.

Government contracts may require bidders to make representations about their costs, prices, and profit, or to submit costs reports that accurately reflect the costs that the contractors incurred. In a time and materials contract, a contractor may inflate costs or rates, shift costs from one contract to a different contract, or misallocate costs between contracts. Such accounting fraud in government contracts can be grounds for a whistleblower case under the False Claims Act.

Speak to a Whistleblower Lawyer About Your Accounting Fraud Case

Do you have information concerning accounting fraud? Submit our secure form to request a strictly confidential consultation with one of our whistleblower attorneys. Get started today.