CFTC Whistleblower Program 2021 Annual Report Shows Continuing Strength of Program as it Manages Challenging Year

The Commodity Futures Trading Commission issued its required annual report to Congress covering the CFTC Whistleblower Reward Program. The report details the successes of the program over the 2021 fiscal year. Created by the Dodd-Frank Act, the CFTC Whistleblower Program pays awards to eligible whistleblowers who voluntarily provide the Commission with original information, about matters within the CFTC’s jurisdiction, that lead to the recovery of more than $1 million in monetary sanctions.

The CFTC 2021 Annual Report on the Whistleblower Program identifies the number of whistleblower awards granted and the total amount of CFTC whistleblower awards paid, along with other information of interest to potential whistleblowers and their attorneys.

According to the CFTC Whistleblower 2021 Annual Report, during the fiscal year ending September 30, 2021, the Commission:

- Issued 6 final orders granting whistleblower rewards, including some final orders that made awards to multiple whistleblowers;

- Made awards “totaling more than $3 million;”

- Issued 59 final orders denying 68 additional applications for whistleblower rewards on the grounds that the applicants did not meet the program’s requirements;

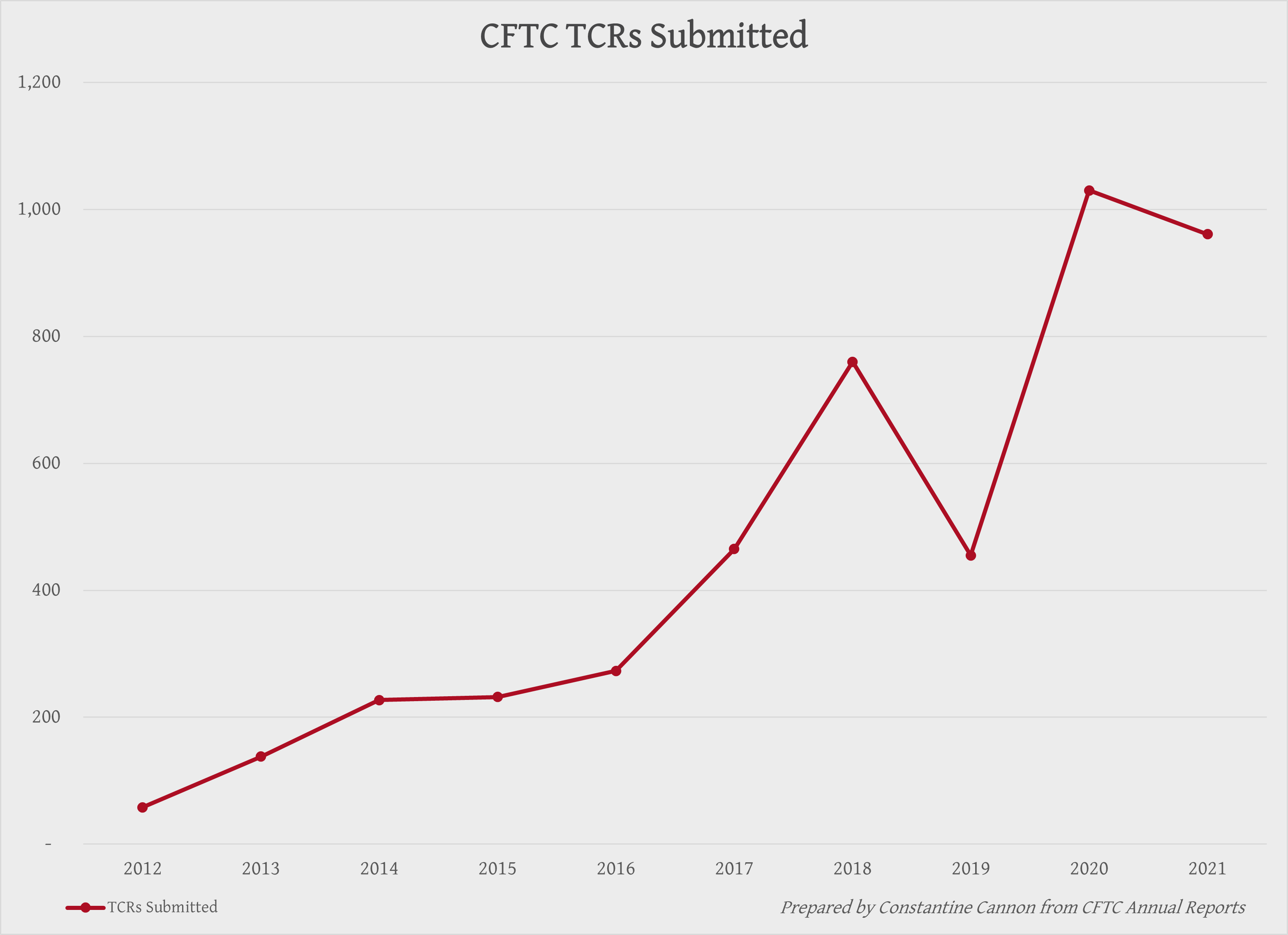

- Received 961 new whistleblower submissions using the CFTC “tip, complaint, or referral,” or “TCR” forms and procedures; and,

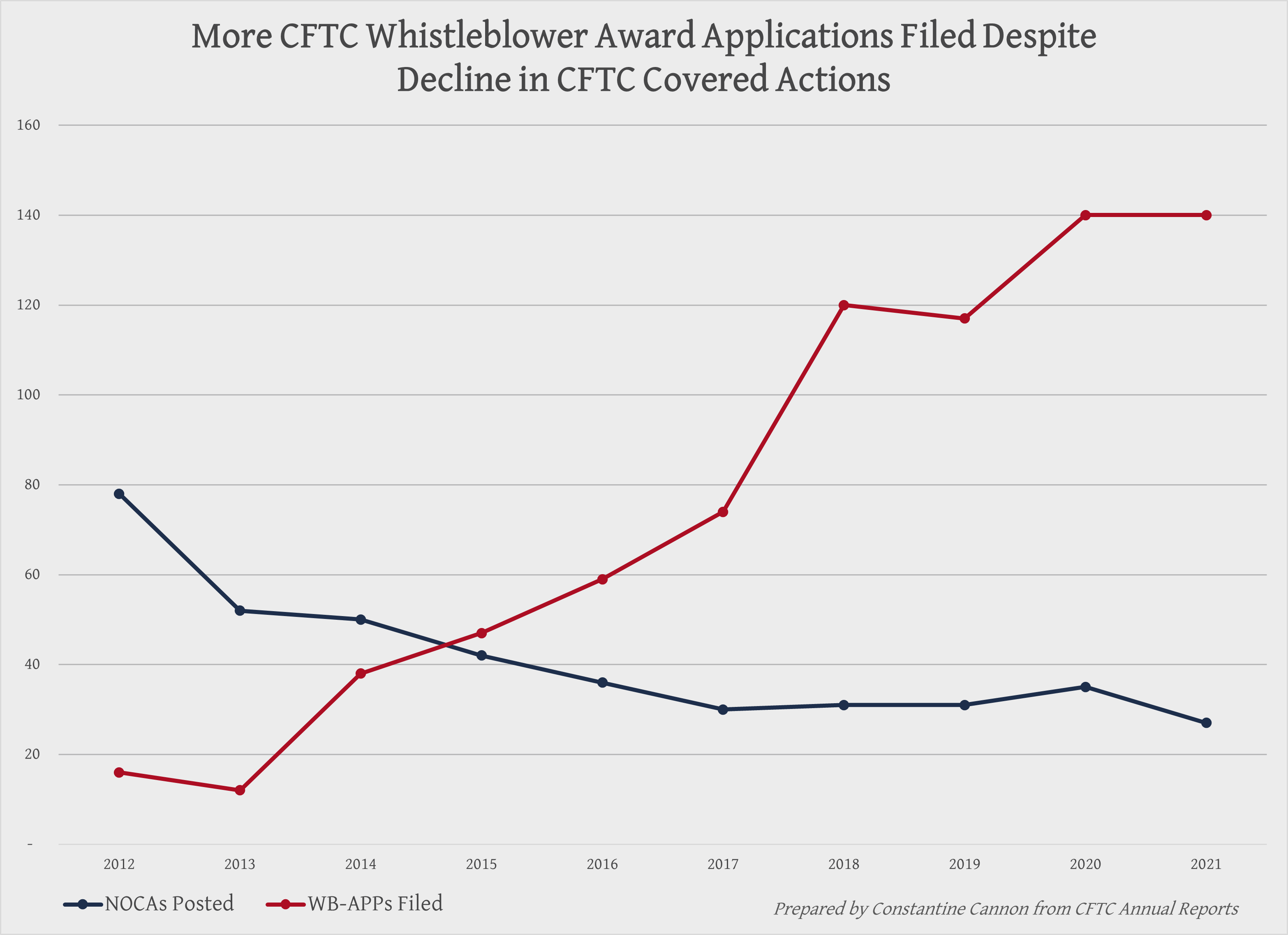

- Received 140 whistleblower award applications using the CFTC WB-APP forms and procedures, tying last year’s high.

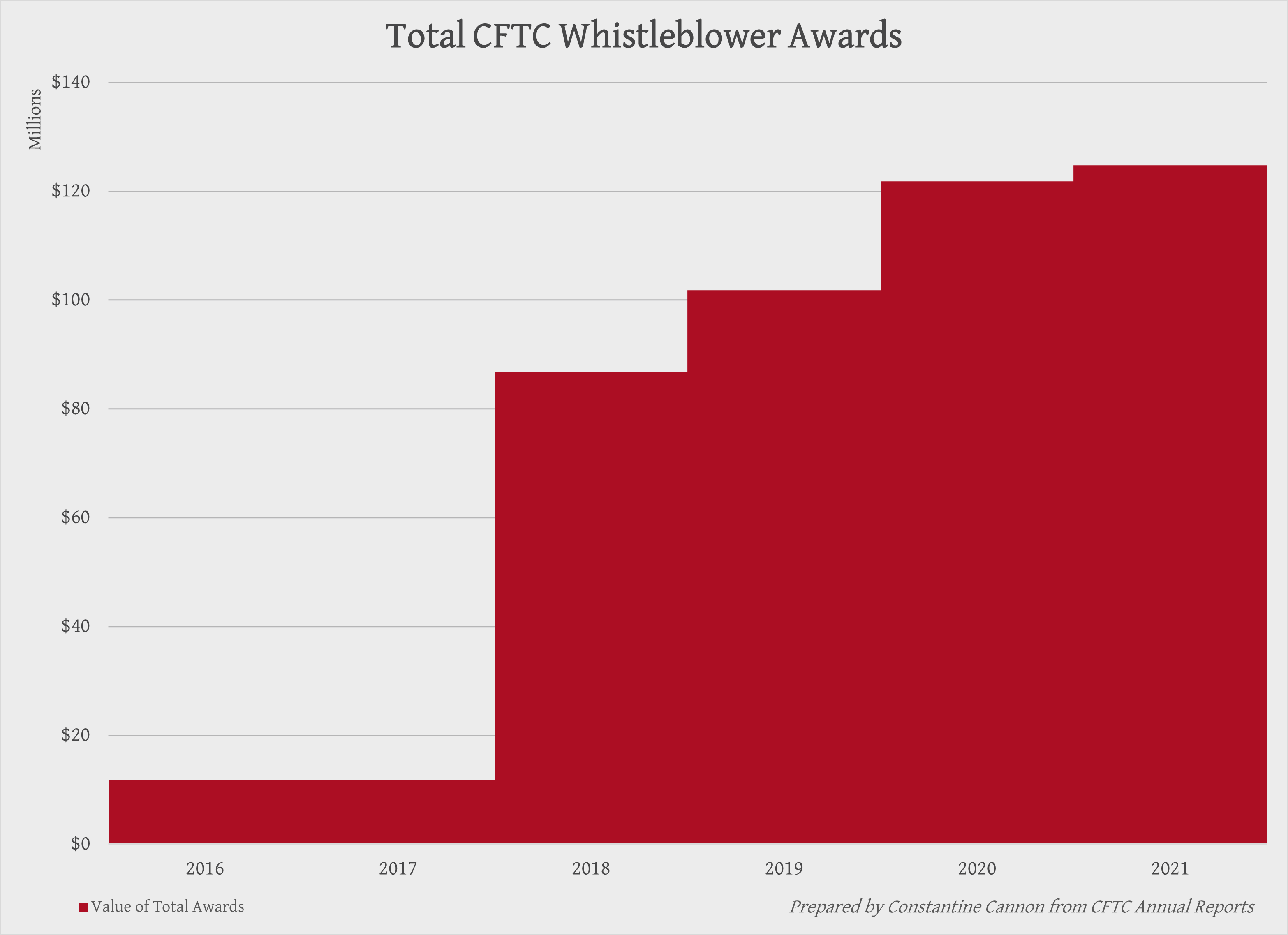

With this year’s whistleblower awards, the CFTC reports that it has granted more than $123 million in awards. While this is great news for whistleblowers, it is even better news for the integrity of the markets regulated by the CFTC: The Commission reports that between 30% and 40% of its ongoing investigations involve some whistleblower component, and Commission actions associated with whistleblower awards have resulted in sanctions orders totaling more than $1 billion – a figure that does not account for recoveries in related actions.

Awards Decline, but 2021 was a Ground-Breaking Year for the CFTC

While the CFTC Whistleblower Reward Program has paid more than $123 million in awards, it is notable that over half of that amount was paid in a single year, 2018. After reporting over $20 million in awards in 2020, the second-highest year in terms of award dollars, 2021 saw a return to lower award levels.

However, 2021 was a busy year for the CFTC Whistleblower Program, and we already know that the 2022 report will change the scale on the charts. As we reported in May 2021, the CFTC was facing a dilemma: it was preparing to issue an award of approximately $100 million based on a claim by a whistleblower in the 2015 $2.5 billion Deutsche Bank LIBOR manipulation settlement, but the Customer Protection Fund that is used to pay whistleblower awards had only $117 million in it. Indeed, the 2021 Annual Report shows the available balance of the fund as $101,075,846. A $100 million award would deplete the fund for other whistleblowers, and for other payments required from the fund.

In October, we learned that, in fact, the CFTC’s ground-breaking whistleblower award was for nearly $200 million. While the U.S. enacted the CFTC Fund Management Act over the summer, which will provide critical additional funds for whistleblowers and for operating expenses of the program, the Customer Protection Fund will require an infusion of new funds. As the law now exists, those funds will have to come from monetary sanctions in covered judicial or administrative actions to the extent such recoveries are not otherwise distributed to victims. In the meantime, while whistleblowers can receive orders for awards, they will have to wait to receive distributions.

Increasing Demands on Whistleblower Program, and Competition for CFTC Whistleblower Awards

Securing funding for the CFTC Whistleblower Program is critical because its popularity is only growing. As said above, the CFTC continues to receive a large number of TCRs. This year represents the second-highest year on record.

And, as we reported last year, the CFTC continues to receive a large number of whistleblower award applications (WB-APPs), even in the face of declines in the number of covered actions, referring to recoveries that are eligible for payout of whistleblower awards. 2021 tied 2020 for the number of WB-APP submissions, even though the number of Covered Actions has not increased.

The increasing number of WB-APPs puts a burden on the CFTC Whistleblower staff. With both the number of TCRs increasing, and the number of WB-APPs increasing, whistleblowers will face increasing competition for CFTC attention and whistleblower rewards.

Lessons for Potential CFTC Whistleblowers

The CFTC Whistleblower Program provides incentives to individuals to report violations occurring in markets regulated by the CFTC. Monetary rewards, prohibitions on job retaliation, and confidentiality protect and compensate whistleblowers who report improper conduct. Whistleblowers play a vital role in CFTC enforcement efforts, exposing bad actors and violations of the laws and regulations that protect market participants and our financial system.

The CFTC 2021 Annual Report states that whistleblower submissions covered a wide range of wrongful activities, including insider trading; position limit violations; reporting violations; false statements to the government; failures to supervise; record-keeping or registration violations; swap dealer business conduct; wash trading; solicitation, misappropriation, and other types of fraud; and the use of deceptive or manipulative devices in trading, including spoofing and other forms of disruptive trading or market manipulation.

With so many more TCRs being submitted, and so many WB-APPs being submitted, it is important for a whistleblower to ensure that they have met all program requirements and presented their information and arguments in the most effective way possible. Frauds that violate the Commodity Exchange Act and applicable regulations are often complicated, and an experienced attorney can help evaluate evidence, effectively present information to government decision-makers, and protect the whistleblower’s claim for an award, including in any related action.

The whistleblower attorneys of Constantine Cannon have extensive experience representing Dodd-Frank whistleblowers before the CFTC and SEC, and understand the complicated, constantly changing landscape of whistleblower laws. If you would like more information or would like to speak to a member of Constantine Cannon’s whistleblower lawyer team, please contact us for a confidential consultation.

Read More:

- The CFTC Whistleblower Program

- What Whistleblowers Should Know about the Dodd-Frank Act

- Fraud in Markets Regulated by the CFTC

- CFTC Whistleblower Program Faces Challenges of its Success: What Whistleblowers Should Know

- Think you have a whistleblower case?

- Contact us for a Confidential Consultation

Tagged in: CFTC Whistleblower Reward Program, Financial and Investment Fraud, Fraud in CFTC-Regulated Markets, Legislation and Regulation News, Statistics,