IRS Whistleblower Office Issues Fiscal Year 2022 Report: Challenges Persist but Program Recovers $172.7 Million Nonetheless

The IRS Whistleblower Office has released its Annual Report to Congress for the 2022 fiscal year. The report describes the tax fraud tips sent by whistleblowers to the IRS Whistleblower Program, the proceeds collected thanks to those tips, and the whistleblower awards made by the Program from October 2021 through September 2022. While the Program’s collected proceeds and whistleblower awards increased slightly this year, so did the number of outstanding claims and the length of processing timelines. Nonetheless, as the 2022 Report demonstrates, federal funding for the IRS Whistleblower Program is money well-spent.

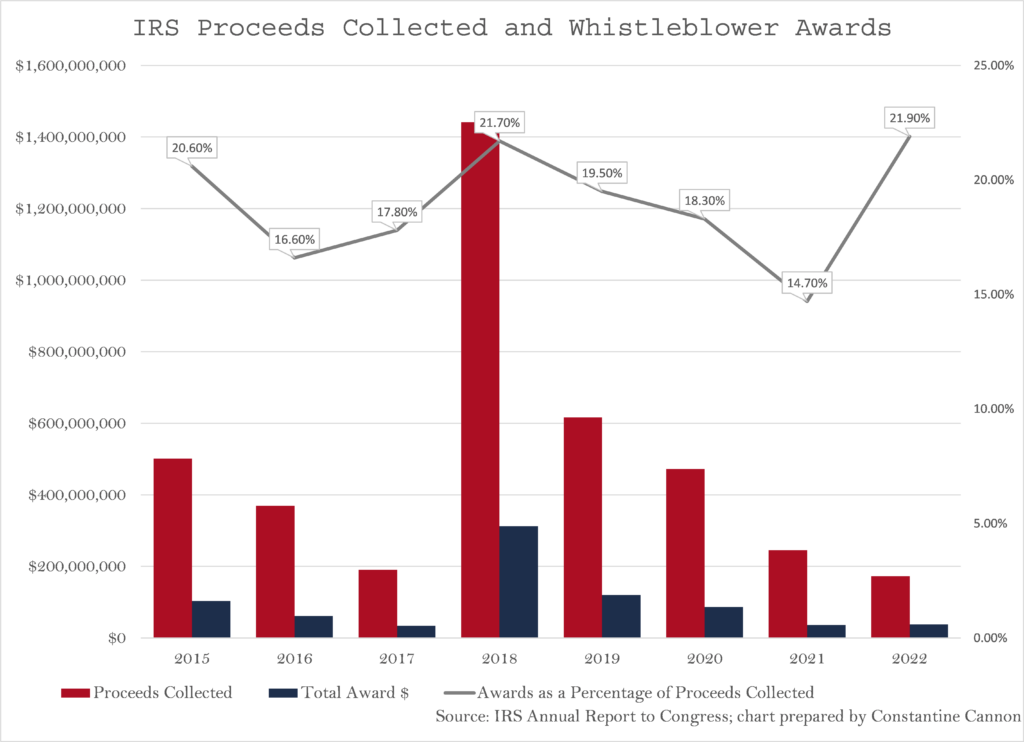

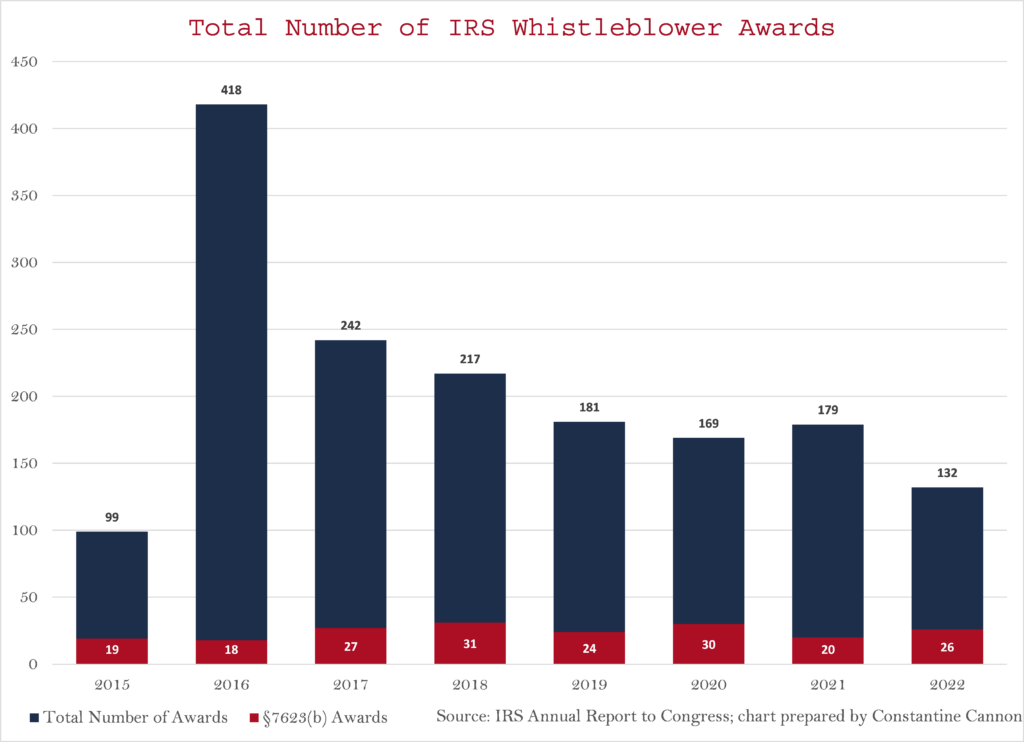

As of fiscal year 2022, the IRS Whistleblower Office has collected $6.6 billion thanks to whistleblowers and made whistleblower awards of $1.1 billion. In 2022 alone, the IRS Whistleblower Office collected more than $172.7 million in proceeds thanks to whistleblower submissions and made 132 whistleblower awards totaling $37.8 million (21.9% of the collected proceeds). For the first time since 2018, the annual total of whistleblower-prompted recoveries increased from the prior year, from $36.1 million in 2021 to $37.8 million in 2022. In another promising development for whistleblowers, the percentage of the total recoveries allocated to whistleblower awards went up for the first time since 2018—from 14.7% in 2021 to 21.9% in 2022. This is a significant milestone considering the average percentage award since the establishment of the Office is just 16.7%.

The vast majority of the 2022 IRS whistleblower awards were made under section 7623(a), which, as we’ve explained before, tend to be to be smaller than section 7623(b) awards. This isn’t surprising since many of the most common frauds reported in IRS whistleblower submissions are those likely to fall under §7623(a): unreported income, underreporting wages, false dependent exemptions, employee/subcontractor classifications, etc.

In fiscal year 2022, the IRS made 26 awards under Internal Revenue Code §7623(b) totaling $34.4 million—up from 20 awards totaling $27.3 million in 2021. While the average §7623(a) award was less than $32,000, the average §7623(b) award was over $1.3 million.

Claims Backlog and Processing Timelines Continue to Grow

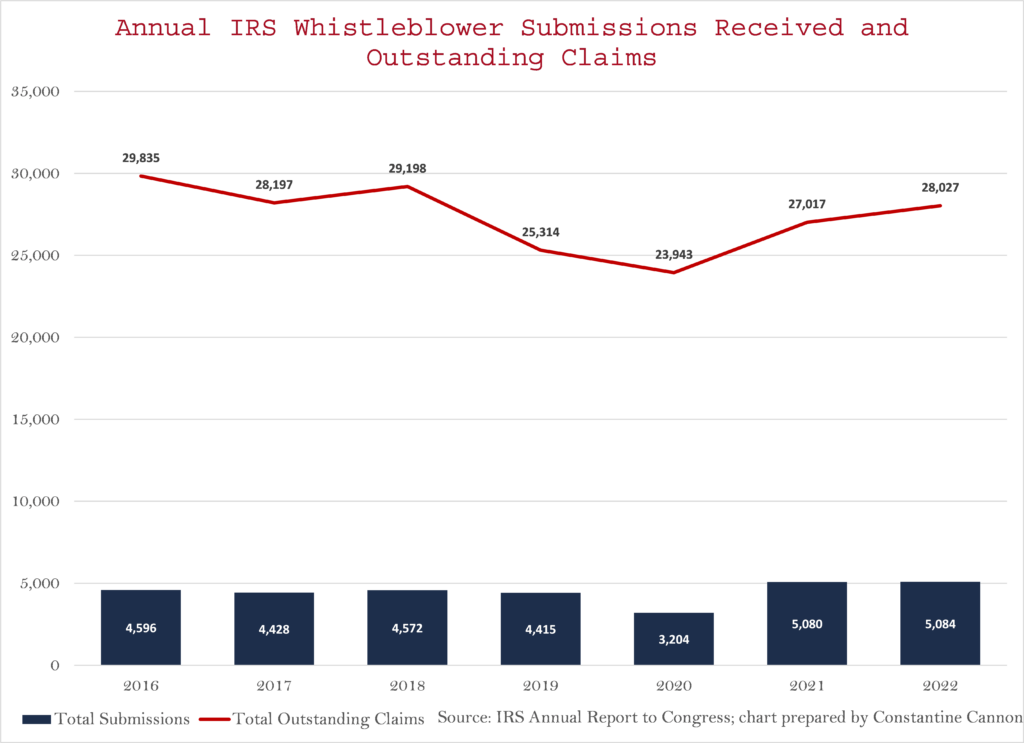

The claims backlog and processing timelines increased once again in 2022. According to the 2022 report, the Whistleblower Office currently has 28,027 open claims—over 1,000 more open claims than in 2021. Nearly half of the open claims are section 7623(b) claims. The IRS Whistleblower Office closed 11,605 claims in 2022, a 7.8% decrease from the year before.

Average claims processing times for award payments increased in 2022, by 1.3% for section 7623(b) awards and 14.9% for 7623(a) awards. Section 7623(a) claims took an average of 9.79 years to process, and section 7623(b) claims took an average of 11.24 years to process. Once again, the report notes a “high likelihood that the average claim processing times will continue to increase as claim inventory continues to age while the Whistleblower Office awaits audits, exams, investigations, appeals, tech services, collection, statutes to expire, and whistleblower litigation.”

Funding for the IRS Whistleblowers Program is Money Well-Spent

The IRS has faced repeated budget cuts and could face more cuts this year. While the IRS received $80 billion in new funding this year, $1.4 billion has already been rescinded and another $20 billion will be redirected elsewhere. As IRS Commissioner Danny Werfel recognizes, these cuts will have negative consequences for the federal budget on the whole: “scaling back means less accountability for the wealthy who . . . aren’t paying.” And as their track record has shown, investing in the IRS Whistleblower Office pays dividends for the public fisc several times over.

When legislators proposed increasing the awards for section 7623(b) claims and establishing an IRS Whistleblower Office, the Congressional Budget Office estimated these changes would nearly double the recoveries to the government over ten years—adding $744 million on top of the $748 million it anticipated to recover under the existing law. Almost twenty years later, those numbers are dwarfed by the actual proceeds the IRS Whistleblower Program has collected to date—$6.6 billion. These substantial recoveries far exceed the awards to the whistleblowers ($1.1 billion) and the cost of the program.

Notwithstanding recent positive developments in whistleblower awards and collected proceeds, the Program has struggled to keep pace with the tips it receives. We’ve written more than once on changes that would strengthen the IRS Whistleblower Program, encouraging the IRS to improve transparency and accelerate its claims and award process. Under the leadership of Director John Hinman, it looks like the IRS Whistleblower Office is on the same page. The 2022 report identified several administrative priorities designed to address these goals, such as: (1) identifying opportunities to digitize the claims process; (2) finding ways to pay awards sooner; and (3) improving the process for whistleblowers to review their administrative claim file without having to litigate a claim in Tax Court. The IRS Whistleblower Program is heading in the right direction but needs resources to overcome its significant claims backlog and processing timelines. Now is the time to invest more—not less—in this important program.

Read More:

- IRS Whistleblower FAQs

- Tax Fraud

- The IRS Whistleblower Program

- How Congress and the IRS Can Fulfill the Promise of the Tax Whistleblower Program

- Contact Us for a Confidential Consultation

Tagged in: IRS Whistleblower Reward Program, Statistics, Tax Fraud,