SEC Whistleblower Program 2022 Annual Report Shows Continued Strength of Program

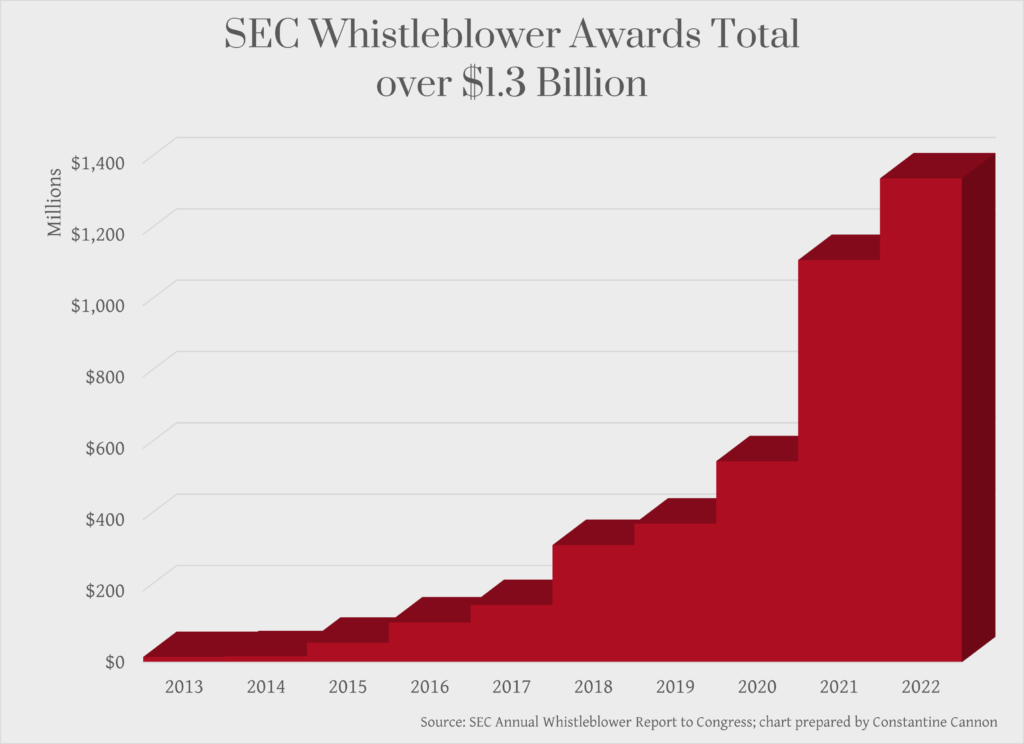

Last week the SEC Whistleblower Office released its 2022 Annual Report, with office chief Creola Kelly saying that the SEC Whistleblower Program is “effectively incentivizing whistleblowers to make the often difficult decision to come forward with information about potential securities-law violations.” The data confirms that whistleblowers are making a big difference in protecting the markets and investing public. According the to the SEC, since the implementation of Dodd-Frank, enforcement actions involving whistleblowers have resulted in orders for more than $6.3 billion in total monetary sanctions, including more than $4.0 billion in disgorgement orders.

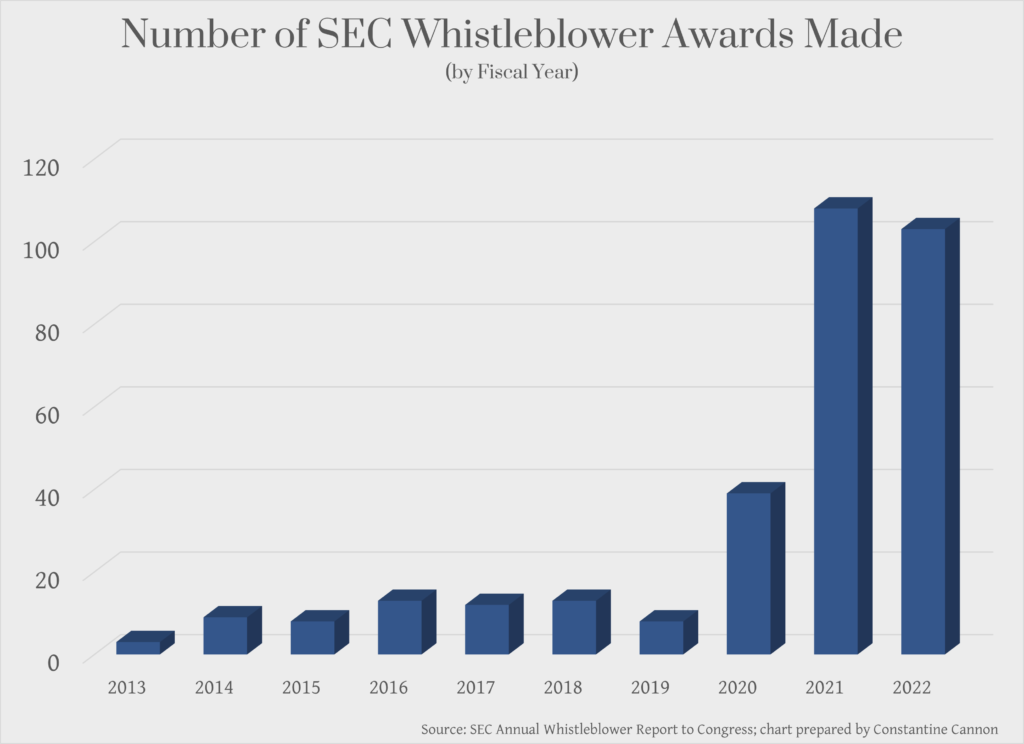

During the fiscal year ending in September 2022, the SEC received the largest number of submissions to the program in its history and kept up 2021’s pace by issuing over 100 whistleblower awards, totaling over $229 million. Since the program began, the SEC has awarded more than $1.3 billion to 328 individual whistleblowers.

The SEC notes in its report that more than 90% of the awards in FY2022 were made under the presumption setting awards at the maximum 30% of the monetary sanctions collected where the award will be less than $5 million. This presumably means that more than 90% of the awards issued were for less than $5 million. While the average award size may be lower, the increased number of awards in FY2022 puts the $229 million in total awards in second place over the history of the program.

The math confirms the decline in average award size: the FY2022 average award was about $2.25 million, which is lower than prior years. While FY2021 had an even larger number of awards issued and an average award size of more than $5 million, the FY2021 average award size was increased by two awards of more than $100 million.

The SEC Office of the Whistleblower posts a “Notice of Covered Action” for every SEC enforcement action that results in monetary sanctions of more than $1 million. The SEC website shows 155 NoCAs posted in FY2022. According to the report, the 100 whistleblower awards issued during the fiscal year arose from 70 Covered Actions. Whistleblowers can also receive awards if their original information leads to a recovery in a “related action” brought by the Department of Justice, the CFTC, a state attorney general, or other identified law enforcement actors. In FY 2022, the SEC issued whistleblower awards in connection with eight related actions.

SEC Annual Report Highlights Features of Whistleblower Claims Submitted

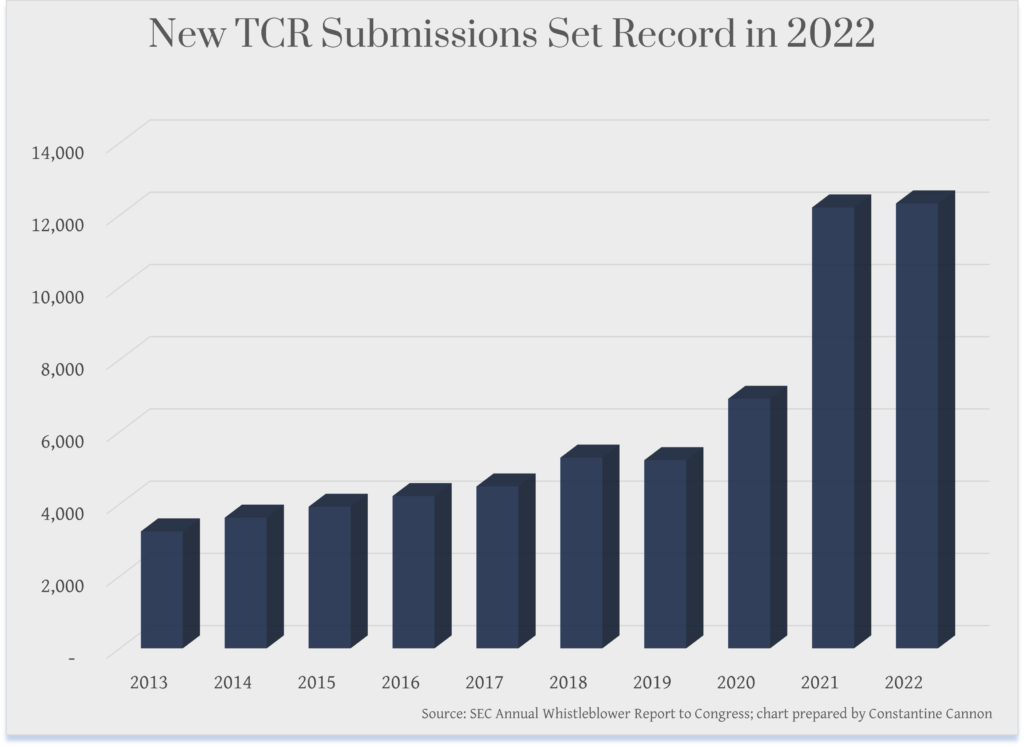

SEC whistleblowers typically submit their information to the SEC by filing a TCR, an abbreviation for “Tip, Complaint, or Referral.” While TCR submissions have been steadily increasing over the years, there was a sharp jump in FY2021, and that pace continued in FY2022. In fiscal year 2022, the SEC reported a new record number of 12,322 TCR submissions.

The 2022 Annual Report includes data on the nature of wrongdoing reported by whistleblowers. Four categories dominate here, accounting for two thirds of the TCRs submitted: manipulation, offering fraud, initial coin offerings and cryptocurrencies, and corporate disclosures and financials. The SEC Whistleblower Program covers claims arising around the country and around the world, and receives tips from whistleblowers throughout the U.S. and around the world.

The Office of the Whistleblower evaluates whistleblower tips as they come in, and refers them to appropriate enforcement personnel as needed. In addition to processing and directing TCRs, the SEC Office of the Whistleblower devotes much of its work to evaluating claims for whistleblower rewards submitted after a successful enforcement action. In prior annual reports, OWB has included information about these aspects of its work. However, the FY2022 Annual Report was shorter than reports issued in prior years, and did not include this information.

What the 2022 SEC Annual Report Tells Whistleblowers

The SEC annual report on enforcement actions for FY2022, issued the same day as the whistleblower report, states that “the SEC’s Office of the Whistleblower is an integral part of the Enforcement Program.” The results of the program in FY2022 – the second highest in the program’s history – certainly support this assertion.

The SEC’s FY2022 Whistleblower Report provides helpful information about the factors – both positive and negative – that the agency considers in determining award percentages when the 30% presumption does not apply. The significance of the information provided by the whistleblower is a “critical driver” of award percentages and, especially when there are multiple meritorious whistleblowers, “could be the most important factor when apportioning award amounts.” The agency also considers the assistance provided by whistleblowers, including “helping staff decipher complex transactions, identifying key witnesses, documents or other sources of information, and communicating with staff” and others during the investigation or litigation. Another important factor that could increase a whistleblower’s awards is law enforcement interest, which the SEC notes may be high in cases with ongoing violations, or where violations are occurring abroad, which can make it more difficult to detect or to gather evidence about without a whistleblower’s cooperation.

The report also noted the potential role of internal compliance or reporting systems. “While claimants are not required to report internally, their award percentage may be increased if they do so.” The report highlights one whistleblower award made to a compliance officer who first reported internally, and, when the company did not act, the individual waited the 120 period set forth in rules and then reported to the Commission. The report also notes that interference with internal reporting systems can be the basis for reducing a whistleblower award.

The SEC also noted factors which could negatively impact an award percentage. In one case, a whistleblower was denied an award where they were found to have made “materially false statements both during the staff’s investigation and in the individual’s application for a whistleblower award.” Another significant factor that could reduce an award is unreasonable delay in reporting. In FY2022, the SEC reduced the award percentage of eight whistleblowers who it found unreasonably delayed in reporting. In two of those cases, the SEC also found that the whistleblower participated in or benefited from the underlying misconduct. A whistleblower’s culpability can also be grounds for reducing an award.

Individuals with specific, timely, and credible information about violations of the securities laws can submit tips to the SEC Whistleblower program. With the amount of information flowing in to the SEC, whistleblowers must present the best case they can. Experienced whistleblower lawyers can help. The Whistleblower Lawyer Team at Constantine Cannon helps whistleblowers evaluate their potential claims and determine whether the misconduct can form the basis of a whistleblower claim. With a history of successful partnerships with government agencies including the SEC, we know how to collect and present information to the relevant decision-makers, and how to provide effective assistance to the government throughout the investigation and any subsequent proceedings, including a claim for a whistleblower reward. If you would like more information or would like to speak to a member of Constantine Cannon’s whistleblower lawyer team, please contact us for a Confidential Consultation.

Read More:

- The SEC Whistleblower Program

- Financial & Investment Fraud

- What Potential Whistleblowers Need to Know About the Dodd-Frank Act

- SEC Enforcement Actions

- Think you have a whistleblower claim?

- Contact us for a confidential consultation

Tagged in: Financial and Investment Fraud, SEC Whistleblower Reward Program, Securities Fraud, Statistics,