Time Limits Under The False Claims Act

If you have information about fraud, you may be able to bring a lawsuit on behalf of the government under the False Claims Act and receive a portion of any recovery.

However, you should keep an eye on the clock. You have limited time to start your case before it could be barred by the False Claims Act’s statute of limitations or “first-to-file” rule.

What you should know about the False Claims Act Statute of Limitations

What Is a Statute of Limitations?

Statutes of limitations apply to almost all legal claims and set limits on the amount of time you have to file a lawsuit. In general, courts will dismiss claims brought after the statute of limitations expires.

How Does the False Claims Act Statute of Limitations Work?

There are two main types of actions you might want to pursue under the False Claims Act:

- A qui tam action on behalf of the government, or

- A whistleblower retaliation action for injuries you have suffered personally.

Each of these actions is subject to a different statute of limitations.

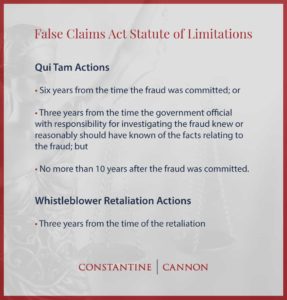

Qui Tam Actions

A qui tam action is a lawsuit brought by a private individual on behalf of the government.

Under the False Claims Act, someone who has evidence of fraud against the government can blow the whistle through a qui tam action.

This person is referred to as the “relator” and typically receives 15% to 30% of the government’s recovery.

The False Claims Act (FCA) statute of limitations for qui tam actions is the longer of:

- Six years from the time the fraud was committed; or

- Three years from the time the government official with responsibility for investigating the fraud knew or reasonably should have known of the facts relating to the fraud; but

- No more than 10 years after the fraud was committed.

So how does this statute of limitations work for qui tam actions? Let’s look at a few examples.

Scenario 1

On July 4, 2015, a government contractor significantly overcharges the government for its services. On September 1, 2016, the government learns of the fraud. Under these circumstances, the statute of limitations will expire on July 4, 2021, six years after the fraud took place.

Scenario 2

The fraud again occurs on July 4, 2015, but this time, the government does not learn of the fraud until September 1, 2019. In this scenario, the qui tam statute of limitations will extend the time to file until September 1, 2022, three years after the government learned of the fraud.

Scenario 3

This time, the fraud occurs on July 4, 2011. The government learns of the fraud on September 1, 2019. Here, the statute of limitations for a qui tam action will expire on July 4, 2021, ten years after the fraud’s commission.

Whistleblower Retaliation Actions

Unfortunately, companies often retaliate against employees or partners who blow the whistle on their fraudulent practices.

The False Claims Act makes this illegal. It provides a way for relators to be reinstated or get money damages if they have suffered retaliation.

The statute of limitations for whistleblower retaliation actions under the False Claims Act is three years from the time of the retaliation.

What Is the First-to-File Rule?

Even when there is plenty of time before the statute of limitations expires, the False Claims Act’s first-to-file rule makes it important for a whistleblower to speak with experienced qui tam counsel as soon as possible.

Sometimes, more than one whistleblower initiates a qui tam action for the same fraudulent conduct. If this happens, only the first to file will be able to get the 15-30% share of the whistleblower recovery that the False Claims Act promises relators. Those who file after the first-filed action are not entitled to a reward.

How Can I Initiate a False Claims Act Suit?

Lawsuits under the False Claims Act require specialized expertise.

In the last two decades, Constantine Cannon has helped whistleblower clients recover more than $350 million in awards. Our experienced lawyers understand the courage it takes to become a whistleblower and the challenges that come with that. We want to ensure that you have all of the information that you need before you hire a whistleblower law firm.

If you are considering coming forward with information about fraud, call us at 866-753-2144 for a confidential attorney consultation or complete our online form.

Learn more about being a whistleblower:

Tagged in: FCA Federal, Multiple Whistleblowers and First-to-File, Statute of Limitations, Whistleblower Answers,