SEC Whistleblower Program Reports Stunning 2021 Results

If you have been watching the SEC Whistleblower Program over the last year, you already know that this has been a big year, with the program passing one billion in total whistleblower awards as enforcement matters based on information from whistleblowers have resulted in orders for nearly $5 billion in monetary sanctions. This week, the SEC released its 2021 Annual Report on the SEC Whistleblower Program, and, even though we knew to expect big numbers, the results are still stunning. Simply put, the SEC Whistleblower Program had an amazing year in 2021.

The fiscal year ending in September 2021 saw many milestones: the largest number of whistleblower awards in total dollars, the largest number of individuals receiving awards, and, the largest number of submissions to the program. In 2021, with the country still recovering from a global pandemic, the Commission can proudly claim that it made more whistleblower awards in FY 2021 than in all prior years combined. Since the program began, the SEC has awarded more than $1.1 billion to 214 individual whistleblowers.

In achieving these stunning numbers, the SEC Whistleblower Program exercised its authority under new rules designed to streamline claim processing. The 2021 awards also demonstrate the breadth of the program, with substantial awards accruing to international whistleblowers, to whistleblower who submitted independent analysis, and where SEC enforcement actions and related actions resulted in dispositions including deferred prosecution agreements.

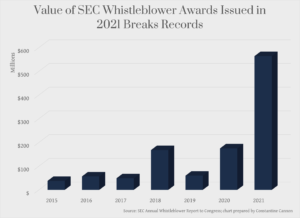

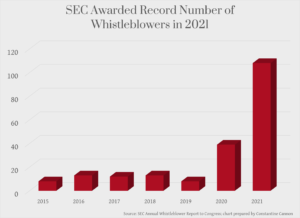

SEC Issues Record-Breaking Whistleblower Awards

In the 2021 fiscal year, the SEC awarded approximately $564 million to 108 individuals. This represents both the largest dollar value of awards in any year, and the largest number of individuals to receive whistleblower awards in any year.

As these graphs show, the 2021 awards are even more remarkable. As we reported in 2020, at this point last year the SEC had issued total of $562 million in awards to 106 whistleblowers. This means that the Commission made more whistleblower awards in FY 2021 than in all prior years combined.

The awards issued in 2021 include three of the largest awards in the history of the program:

- A $114 million award to two unnamed individuals whose information substantially contributed to an SEC enforcement action and two related actions by other enforcement agencies.

- A $114 million award to a whistleblower whose information resulted in the opening of investigations, and more than half of which originated from the government’s recovery in a related action.

- A $50 million award to joint whistleblowers who provided information, voluminous documents, and substantial assistance that led to the return of tens of millions of dollars to harmed investors.

SEC Annual Report Highlights Features of Whistleblower Claims

The SEC Whistleblower Program covers claims arising around the country and around the world. In 2021, the SEC reported receiving whistleblower submissions from individuals in each state in the U.S., the District of Columbia, and 99 foreign countries. 20% of award recipients were based outside the U.S., hailing from five different continents. The countries submitting the most tips are: the United States, Canada, the People’s Republic of China, and the United Kingdom.

Of the final award orders issued in FY 2021, approximately 85% were at the statutory maximum of 30%, with 10% in the range of 20 to 29%, and approximately 5% in the range of 10 to 19%.

Whistleblowers can receive awards if their original information leads to a recovery in a “related action” brought by the Department of Justice, the CFTC, a state attorney general, or other identified law enforcement actors. In FY 2021, 17 whistleblower awards were made based, in part, on collections in related actions.

Whistleblowers received awards in connection with Deferred Prosecution Agreements and Non-Prosecution Agreements, taking advantage of new SEC rules discussed in more detail below. Whistleblower awards totaling more than $117 million were issued in connection with four DPAs and NPAs.

Whistleblowers received awards where the “original information” they submitted consisted of their “independent analysis,” which, according to SEC rules, “must provide evaluation, assessment, or insight beyond what would be reasonably apparent to the Commission from publicly available information.” In FY 2021, the SEC issued eight awards that were based at least in part on independent analysis, including the second largest award ($110 million) to a single whistleblower in the history of the program.

Whistleblower tips may result in the opening of an action, or they may significantly contribute to an already ongoing investigation. In FY 2021, approximately 56% of awards were made to those whose information caused the opening of a new investigation, and approximately44% of awards were made to those who contributed to ongoing investigation.

While whistleblowers do not need to be company insiders, in FY 2021, approximately 60% of award recipients were current or former insiders of the involved entities. Of those, more than 75% had initially raised their concerns internally.

Whistleblowers may jointly submit information. In FY 2021, six of the matters for which whistleblower awards were ordered involved two or more whistleblowers who had jointly submitted information.

The SEC Whistleblower Process

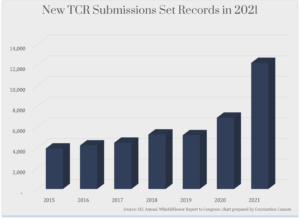

SEC whistleblowers typically submit their information to the SEC by filing a TCR, an abbreviation for “Tip, Complaint, or Referral.” While TCR submissions have been steadily increasing over the years, in fiscal year 2021, the SEC reported a record number of TCR submissions: 12,200, more than a 75% increase from FY 2020.

The Office of the Whistleblower, working with the SEC Office of Market Intelligence, evaluates whistleblower tips alleging violations of securities laws, referring them to appropriate enforcement personnel as needed. In FY 2021, the OWB reports that it is tracking over 1,300 matters in which a whistleblower’s tip has caused a Matter Under Inquiry or investigation to open, or has been forwarded to Enforcement staff for review and consideration in connection with an ongoing investigation.

In addition to processing and directing TCRs, the SEC Office of the Whistleblower devotes much of its work to evaluating claims for whistleblower rewards submitted after a successful enforcement action.

The SEC Office of the Whistleblower posts a “Notice of Covered Action” for every SEC enforcement action that results in monetary sanctions of more than $1 million. In FY 2021, the SEC posted 150 NoCAs.

Whistleblowers seeking an award must submit a claim for an award within 90 days of a NoCA. The process of reviewing whistleblower award applications is time-consuming, with OWB staff analyzing information provided by the claimant, reviewing prior correspondence, and communicating with investigative staff in the underlying action.

The OWB staff then prepares a recommendation regarding an award application for Claims Review Staff, taking account of the claimant’s eligibility, the complexity of the action, the number of claimants who applied for an award, and other factors. Claims Review Staff then issues a Preliminary Determination of award. In FY 2021, the SEC’s Office of the Whistleblower issued 354 preliminary determinations. In making this high number of preliminary determinations, the SEC took advantage of new rules allowing summary disposition of certain straightforward claims, as well as the adoption of a presumption setting awards at the maximum 30% of the monetary sanctions collected for awards under $5 million. In FY 2021, the SEC issued 69 preliminary summary dispositions.

After receiving a preliminary determination, whistleblowers may request information from the SEC and seek reconsideration. This process again can be time-consuming, resulting in the issuance of a Final Order. In FY 2021, the SEC issued 318 final orders on award claims.

Rule Changes and New Leadership at the SEC

2021 brought a new Chair of the SEC, with the confirmation of Biden nominee Gary Gensler. In addition, former New Jersey Attorney General Gurbir S. Grewal was appointed as the Director the SEC Division of Enforcement. The SEC Office of the Whistleblower saw changes too, with the departure of long-time head Jane Norberg. As we have reported, the SEC recently announced that Nicole Creola Kelly will take over as head of the SEC’s Office of the Whistleblower, replacing Acting Chief Emily Pasquinelli.

Changes to the program also came from amendments to the SEC’s Whistleblower Program Rules, which became effective in December, 2020. These new rules include:

- The adoption of a presumption setting awards at the maximum 30% of the monetary sanctions collected for awards under $5 million.

- Procedures to bar further submissions from claimants who submit three or more frivolous award claims. This year, the SEC barred two “serial submitters” responsible for hundreds of frivolous award applications.

- Rules permitting the SEC to summarily resolve a whistleblower award application in situation including the submission of an untimely claim; the claimant’s failure to have submitted to a tip in the prescribed matter; where the claimant’s information was not used; or where the claimant failed to comply with certain program rules.

- Additional authority for the SEC to award whistleblowers for their contributions to related actions including DOJ actions that result in Deferred Prosecution Agreements or Non-Prosecution Agreements. This rule helps ensure that meritorious whistleblowers do not lose the opportunity for an award simply because of the procedural vehicle that the Commission or the Department of Justice selected to resolve the matter.

The leadership changes already appear to have had an impact on other SEC rule changes. In August, Chair Gensler announced a directive to SEC staff to consider revisions to SEC rule amendments concerning Commission discretion to consider the dollar amount of awards in determining the award, as well as the impact of other available whistleblower reward programs.

What the 2021 SEC Annual Report Tells Whistleblowers

As quoted in the Annual Report, the SEC clearly believes that “[t]he assistance that whistleblowers provide is crucial to the SEC’s ability to enforce the rules of the road for our capital markets,” and whistleblowers are a vital component in the Commission’s enforcement efforts. The extraordinary results of this year show that the SEC backs that belief up by enforcing whistleblower laws which protect and reward whistleblowers.

Individuals with specific, timely, and credible information about violations of the securities laws can submit tips to the SEC Whistleblower program. With the amount of information flowing in to the SEC, whistleblowers must present the best case they can. Experienced whistleblower lawyers can help. The Whistleblower Lawyer Team at Constantine Cannon helps whistleblowers evaluate their potential claims and determine whether the misconduct can form the basis of a whistleblower claim. With a history of successful partnerships with government agencies including the SEC, we know how to collect and present information to the relevant decision-makers, and how to provide effective assistance to the government throughout the investigation and any subsequent proceedings, including a claim for a whistleblower reward. If you would like more information or would like to speak to a member of Constantine Cannon’s whistleblower lawyer team, please contact us for a Confidential Consultation.

Read More:

- The SEC Whistleblower Program

- Financial & Investment Fraud

- What Potential Whistleblowers Need to Know About the Dodd-Frank Act

- SEC Enforcement Actions

- Think you have a whistleblower claim?

- Contact us for a confidential consultation

Tagged in: Financial and Investment Fraud, SEC Whistleblower Reward Program, Securities Fraud, Statistics,