Tax Fraud

This archive displays posts tagged as relevant to tax fraud and underpayment. You may also be interested in the following pages:

November 6, 2019

Winston Shrout, who became a fugitive after being sentenced to 10 years in prison in 2017, has been captured and returned to custody. Shrout led seminars promoting the use of fraudulent financial instruments as a means to avoid taxes, and sold materials for the preparation of such fraudulent instruments. In addition, Shrout failed to file tax returns from 2009 through 2014. DOJHow to Become an IRS Whistleblower

Posted 10/16/19

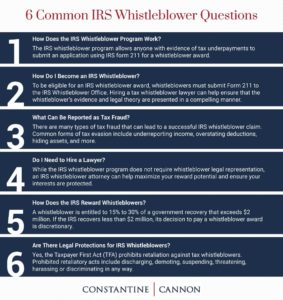

Answers to Common Questions from Prospective IRS Whistleblowers

[caption id="attachment_46025" align="alignright" width="325"] Click for full size image[/caption]

Although some state False Claims Acts allow whistleblowers to bring lawsuits based on violations of state and local tax laws, the federal False Claims Act (FCA) specifically excludes tax claims.

Fortunately, the Tax Relief and Health Care Act of...

Click for full size image[/caption]

Although some state False Claims Acts allow whistleblowers to bring lawsuits based on violations of state and local tax laws, the federal False Claims Act (FCA) specifically excludes tax claims.

Fortunately, the Tax Relief and Health Care Act of...

September 20, 2019

Pradyumna Kumar Samal, the former CEO of two Bellevue, Washington IT firms, has been sentenced to more than seven years in prison for his role in a long-running H1-B visa fraud scheme. Samal's companies, Divensi and Azimetry, were employment agencies in the business of providing IT workers to major corporate clients. Samal would submit fraudulent applications on behalf of foreign workers, claiming that they were being brought to the U.S. to perform a specific job, and instructing them to lie in their own applications, when, in fact, after being admitted, the employees would be benched and unpaid until Samal's companies were able to place them at actual client jobs. In addition, Samal's companies failed to pay employment taxes on behalf of the foreign workers, instead diverting those funds to his personal use. USAO WD WASeptember 5, 2019

The owner of two defense contracting firms, Tico Manufacturing Inc. (TICO) and Military and Commercial Spares Inc. (MCS), has been sentenced to 3 years in prison and ordered to pay $8 million in restitution for conspiring to defraud the Department of Defense. Between 2011 and 2015, Roger Sobrado fraudulently obtained DoD contracts by claiming that conforming parts for critical military equipment, including fighter jets and helicopters, would be supplied through authorized manufacturers. Instead, Sobrado supplied non-conforming parts through non-authorized manufacturers, recruited family members to commit the same fraud, and collected DoD payments from his family members. Additionally, he failed to report almost half of his taxable income for three years, causing the United States to lose a total of $509,962. USAO NJAugust 29, 2019

Following a guilty plea, Treyton Lee Thomas was sentenced to over 21 years in prison and ordered to pay $14.6 million in restitution and forfeiture to the U.S. and victims of his investment fraud ponzi scheme. Thomas's victims included his own father, his father's company, his wife, and his father-in-law. Thomas also pleaded guilty to income tax evasion, having failed to file returns for two decades, while using sham offshore entities to conceal his income. USAO EDNCPromising Changes to IRS Whistleblower Program – Tax Whistleblowers Now Protected Against Retaliation and Improved Communication when Reporting Tax Violations

Posted 08/21/19