How to Become an IRS Whistleblower

Answers to Common Questions from Prospective IRS Whistleblowers

Although some state False Claims Acts allow whistleblowers to bring lawsuits based on violations of state and local tax laws, the federal False Claims Act (FCA) specifically excludes tax claims.

Fortunately, the Tax Relief and Health Care Act of 2006 created an IRS Whistleblower Office dedicated to working with whistleblowers.

Deciding to become a whistleblower is an important decision. Each prospective whistleblower may want to consider a variety of factors, including anonymity, retaliation, or the impact of personal involvement in the conduct.

Experienced IRS whistleblower attorneys can help you explore your options.

Contact our tax whistleblower law firm for assistance.

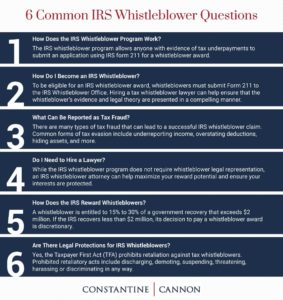

IRS Whistleblower FAQ

- How does the IRS whistleblower program work?

- How do I become an IRS whistleblower?

- What tax crimes are most commonly reported by IRS whistleblowers?

- What evidence does an IRS whistleblower need to provide?

- Do I need to hire a lawyer to be an IRS whistleblower?

- Is there a time limit for becoming an IRS whistleblower?

- How does the IRS reward whistleblowers?

- What are “collected proceeds” on which the reward is based?

- Can you anonymously report someone to the IRS?

- Do the IRS whistleblower statues have an anti-retaliation provision?

How does the IRS whistleblower program work?

The IRS whistleblower program allows anyone who is aware of tax underpayments to submit an application for a whistleblower award using IRS form 211.

The IRS then reviews the whistleblower’s submission and determines what action should be taken. As a part of this process, whistleblowers may be interviewed for more information.

Whistleblowers are entitled to compensation if their information leads directly to an IRS recovery of at least $2 million, including interest and penalties. After the completion of a successful investigation, the IRS Whistleblower Office provides the whistleblower with an award determination.

How do I become an IRS whistleblower?

To be eligible for an IRS whistleblower award, whistleblowers must submit Form 211 to the IRS Whistleblower Office. This form, and any accompanying submission, will ideally contain enough information about the alleged wrongdoing to open a full IRS investigation.

Hiring an experienced IRS whistleblower lawyer can help ensure that the whistleblower’s evidence and legal theory are presented in a compelling manner.

What tax crimes are most commonly reported by IRS whistleblowers?

There are many types of tax fraud that can lead to a successful IRS whistleblower claim. Broadly speaking, any underpayment of taxes may be reported.

Some of the most common forms of tax evasion include:

- Underreporting income;

- Overstating deductions;

- Hiding assets;

- Keeping false records;

- Moving funds between companies to generate artificial tax benefits; and

- Shifting funds to offshore accounts in order to conceal assets or income.

Emerging technologies, such as cryptocurrency, are also providing new methods for fraudsters to conceal income. An experienced IRS whistleblower attorney can help you assess the information you have to determine whether tax law violations are occurring.

What evidence does an IRS whistleblower need to provide?

In general, the more specific you can be when filing a claim with the IRS Whistleblower Office, the better. Providing evidence or documents that demonstrate how the tax fraud scheme is functioning will help the IRS to more effectively investigate the claim and can lead to a higher reward for successful whistleblowers.

Do I need to hire a lawyer to become an IRS whistleblower?

While the IRS whistleblower program does not require that whistleblowers be represented by counsel, an IRS whistleblower attorney can help maximize your reward potential by putting together a compelling and detailed filing. In addition, an experienced tax fraud whistleblower lawyer can help ensure your interests are protected.

Is there a time limit for becoming an IRS whistleblower?

Yes. In many instances IRS whistleblowers must file a timely claim or risk being barred by statutes of limitations. However, the statute of limitations can be indefinite if the false return was filed with an intent to commit tax fraud.

There can also be hinderances to obtaining an award if the information presented in the claim concerns a fraud that has already been reported on or becomes publicly known. It is essential to contact an IRS whistleblower attorney to discuss your legal options.

How does the IRS reward whistleblowers?

To be eligible for a mandatory reward, a whistleblower must provide information that directly leads to a government recovery of more than $2,000,000.

In such cases, the whistleblower will typically be entitled to 15% to 30% of the amount recovered by the government. However, if the IRS recovers less than $2,000,000, its decision to pay a whistleblower award is discretionary.

What are “collected proceeds” on which the IRS whistleblower reward is based?

The “collected proceeds” in an IRS whistleblower case is the total amount of money recovered by the IRS. A whistleblower reward is then calculated as a percentage of this value.

Federal law defines “proceeds” to include taxes owed (including penalties and interest) as well as money obtained through criminal fines, civil forfeitures, sanctions, and other related enforcement actions.

Can you anonymously report someone to the IRS?

No. While your identity must be disclosed to the IRS, the submission process is confidential, and the IRS has strong internal policies to protect IRS whistleblowers’ identities.

If you are concerned about the possibility that your identity may be disclosed, or about the potential risks of filing an IRS whistleblower claim, you may benefit from speaking with an experienced tax whistleblower attorney who can help you explore your options.

Do the IRS whistleblower statues have an anti-retaliation provision?

Yes. Recent legislation enacted anti-retaliation protections for tax whistleblowers.

The law now provides significant remedies to IRS whistleblowers who have been subject to retaliation as a result of their whistleblowing. Prohibited retaliatory acts include discharging, demoting, suspending, threatening, harassing or discriminating in any way.

Think You Have a Tax Whistleblower Case?

Contact Constantine Cannon today to speak confidentially with an IRS whistleblower attorney.

Learn more about being a whistleblower:

Tagged in: Importance of Whistleblowers, IRS Whistleblower Reward Program, Tax Fraud, Whistleblower Answers, Whistleblower Rewards,