DOJ Reports Decline in Total Fraud Recoveries in 2020, but Whistleblower Efforts and Rewards Continue

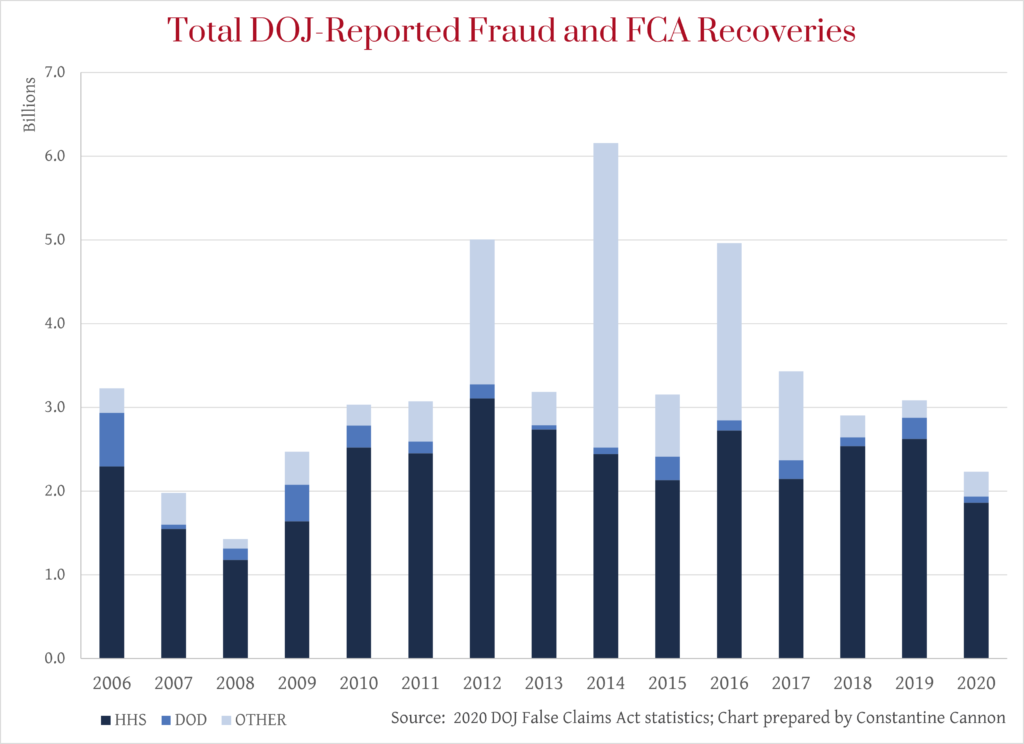

In its annual report of recoveries in fraud and False Claims Act cases, the Department of Justice reported total recoveries of $2.2 billion for the fiscal year ending September 2020. These recoveries represent the lowest reported DOJ recoveries since 2008.

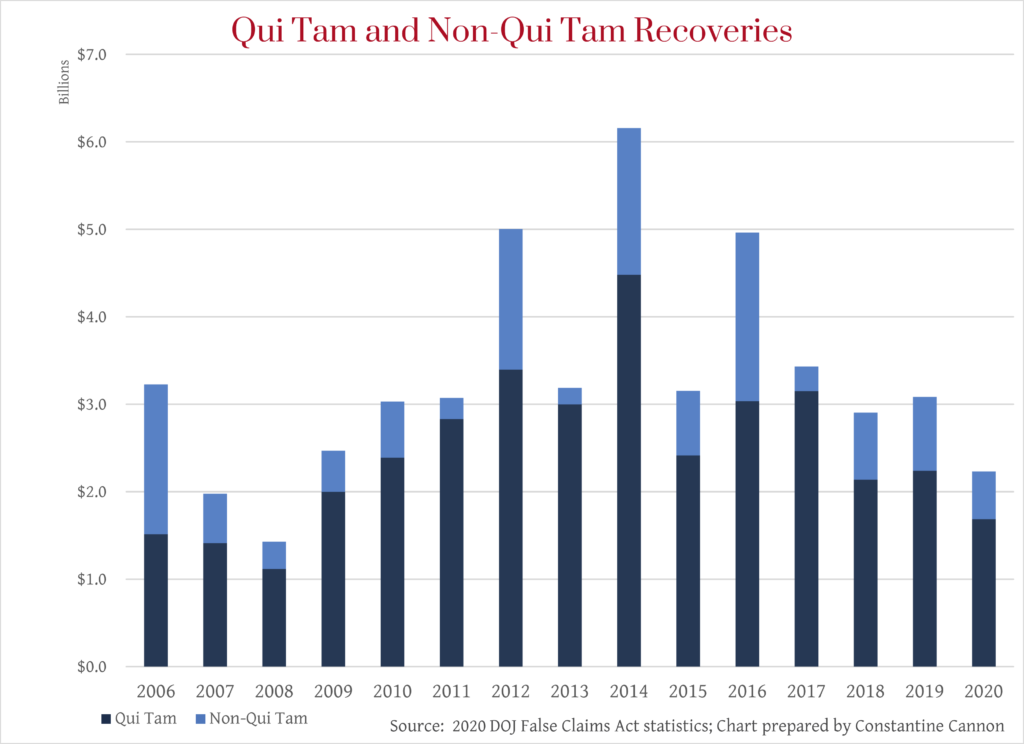

While it is the decline in recoveries that stands out, the 2020 DOJ fraud statistics do share some things in common with prior years. First, whistleblowers were again critical to DOJ’s recoveries. Of the $2.2 billion recovered, nearly $1.7 billion – 76% — was recovered in cases initiated by whistleblowers under the False Claims Act. This percentage represents an increase from prior years, demonstrating the continued importance of whistleblowers. Second, as in prior years, healthcare fraud accounted for the majority of funds recovered: of the $2.2 billion recovered, nearly $1.9 billion – 83% – was attributed to healthcare fraud.

One likely contributor to the overall decline in recoveries, the COVID pandemic, is only alluded to in the DOJ press release, which commends DOJ employees for their hard work in continuing investigations and litigation in the face of the pandemic. Despite these efforts by DOJ attorneys and federal investigators, it is easy to conclude that the pandemic must have affected recoveries, as the legal system was hit by court closures, hearings and trials in civil matters were continued, and individuals adjusted to remote work.

DOJ also notes that the reported recoveries do not include some blockbuster settlements that did not become final before the close of the fiscal year, including settlements with opioid manufacturers Purdue Pharma and Indivior. For more information about top settlements in calendar year 2020, see our Top Ten Lists.

The Role of Whistleblowers in DOJ’s Recoveries – and the Rewards Received by Whistleblowers

In announcing the figures, Acting Assistant Attorney General Jeffrey Bossert Clark said that “Whistleblowers with insider information are critical to identifying and pursuing new and evolving fraud schemes that might otherwise remain undetected,” recognizing that whistleblowers “often make substantial sacrifices to bring these schemes to light” and “protect taxpayer funds.”

Whistleblowers can pursue fraud against the U.S. by filing qui tam actions under the False Claims Act. Since 1986, the U.S. has recovered $46.5 billion in cases initiated by whistleblowers, representing 72% of the total $64.5 billion recovered. The importance of whistleblower qui tam cases over the years can be easily seen:

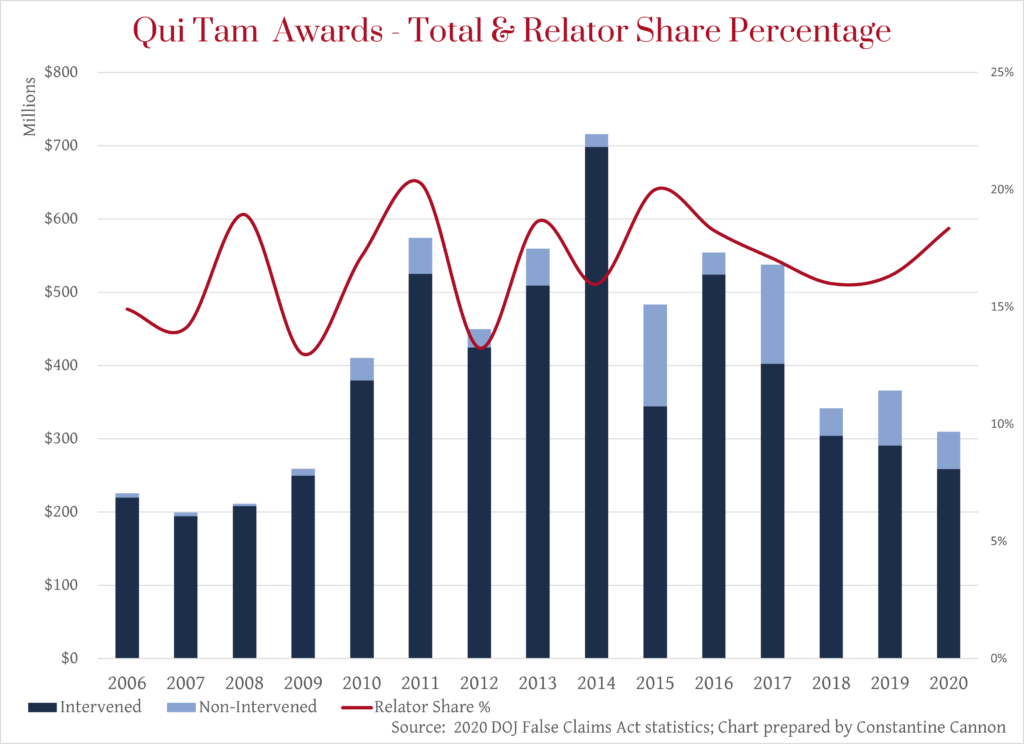

The False Claims Act provides that successful whistleblowers are eligible to receive a share of the government’s recovery – up to 30% if the U.S. has not intervened to litigation the action, and generally between 15 and 25% if the government intervenes. In 2020, the U.S. paid out whistleblower rewards totaling over $304 million. While this total award amount is the lowest since 2009, the low total recoveries explains much of this. The average award in intervened cases was 17%, and the average award in non-intervened cases was 26%, percentages which are in line with historical averages.

Moreover, the 2020 statistics resolve a mystery we observed in DOJ’s 2019 report, which included only $272 million in whistleblower rewards, despite a year of strong recoveries. We speculated that because whistleblower rewards are not always determined and paid in the same fiscal year as the underlying settlement, we might see an adjustment in that 2019 whistleblower award number to account for settlement recoveries and whistleblower rewards that straddled reporting years. That speculation was borne out, and the 2020 statistics add over $93 million to 2019 whistleblower rewards. This brings 2019 whistleblower rewards to almost $342 million, an increase of more than 25%.

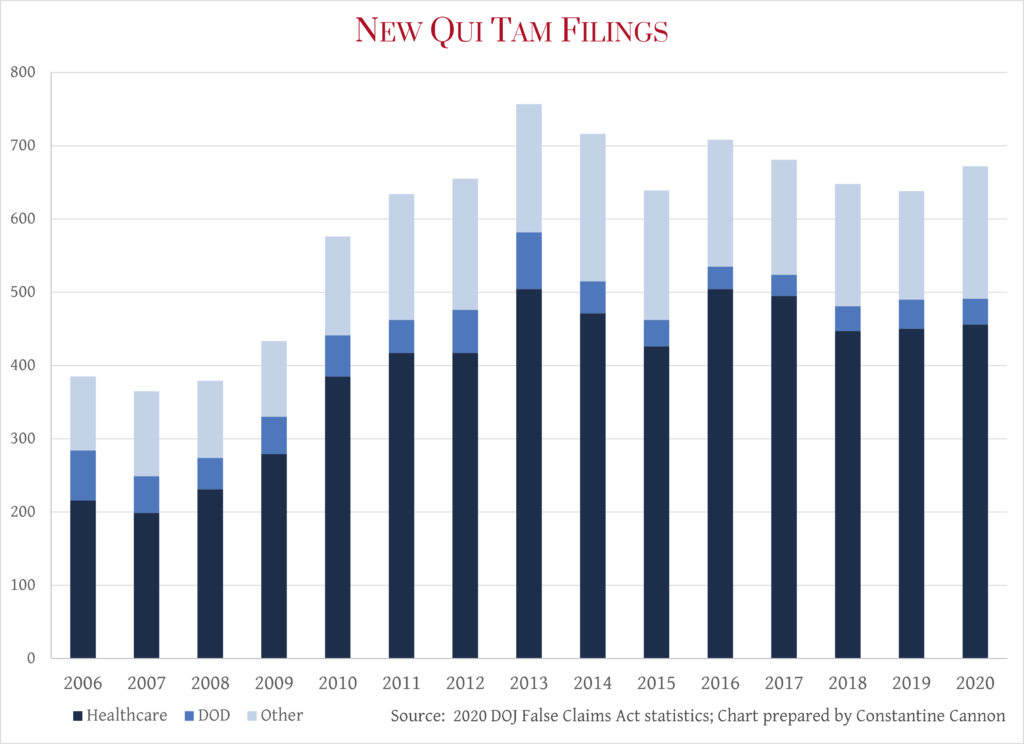

Finally, while the pandemic may have slowed down what could be accomplished through the courts, it did not slow down what whistleblowers were able to accomplish. The number of new cases filed by whistleblowers rose in 2020.

This increase in new filings parallels trends seen in other whistleblower programs such as the SEC. In addition, we expect that the extraordinary government spending in response to the COVID-19 pandemic will generate an increase in qui tam filings as whistleblowers come forward to expose fraud in COVID-19 programs and spending. The increase in whistleblower filings this year should lead to increased government recoveries in the years ahead.

Healthcare Continues to Dominate Recoveries

One feature of DOJ’s recoveries has remained consistent: healthcare fraud dominates. DOJ reports that 83% of its recoveries occurred in cases involving fraud in government healthcare programs including Medicare, Medicaid, and Tricare. As noted by DOJ, healthcare fraud not only harms taxpayers, it often puts patients at risk, including through the provision of unnecessary or inappropriate treatment and medications.

The DOJ press release highlights a number of key healthcare settlements from the year, including:

- A $591 million federal recovery against Novartis resolving claims brought by a whistleblower that it paid unlawful kickbacks to doctors, a settlement that on its own represents 27% of the year’s total recoveries.

- Nearly $200 million in recoveries against pharmaceutical companies Gilead, Novartis, and Sanofi-Aventis as well as several patient assistance foundations resolving claims that the drug companies illegally paid patient copays for their own drugs through the purportedly independent foundations that were actually treated as mere conduits for these payments.

- A $145 million settlement with EHR provider Practice Fusion, Inc., which was alleged to have accepted kickbacks from pharmaceutical companies including Purdue Pharma in exchange for implementing prompts in its EHR system that were designed to increase prescriptions of specific drugs.

There’s More to the Story: What’s Missing from the DOJ Report

As we have cautioned before, the DOJ Annual Report, while useful, is missing critical data that can help paint a more complete picture of the government’s enforcement efforts, and the role of whistleblowers in those efforts. Important categories of recovery and areas where whistleblowers can make a difference are outside the scope of the report, including:

- Criminal penalties;

- Recoveries in cases delegated to United States Attorneys’ offices, instead of those handled by the Civil Division;

- Recoveries by state and local governments

- Recoveries by the government for fraud against non-governmental entities, such as by the Securities and Exchange Commission or Commodity Futures Trading Commission;

- Tax fraud and underpayment

Our Whistleblower Insider blog regularly analyzes the reports of federal agencies that work with whistleblowers, and we have already written this year about the annual reports from the whistleblower programs of the SEC, CFTC, and IRS. If you would like more information about these annual reports or have questions about bringing a whistleblower claim, please contact us for a confidential conversation.

Read More:

- The False Claims Act

- Healthcare Fraud

- Government Contract Fraud

- DOJ Enforcement Actions

- Top-10 Lists of Fraud and Whistleblower Cases

- I think I have a whistleblower case

- The Constantine Cannon Whistleblower Team

- Contact Us for a Confidential Consultation

Tagged in: Defense Contract Fraud, FCA Federal, Government Procurement Fraud, Government Programs Fraud, Healthcare Fraud, Importance of Whistleblowers, Pharma Fraud, Statistics,